Summary

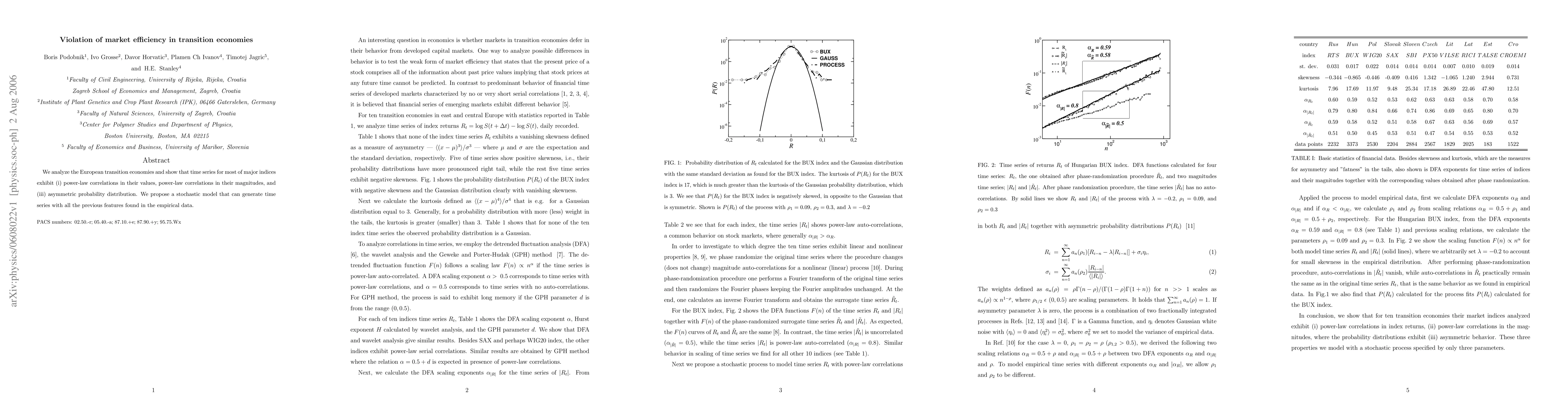

We analyze the European transition economies and show that time series for most of major indices exhibit (i) power-law correlations in their values, power-law correlations in their magnitudes, and (iii) asymmetric probability distribution. We propose a stochastic model that can generate time series with all the previous features found in the empirical data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)