Summary

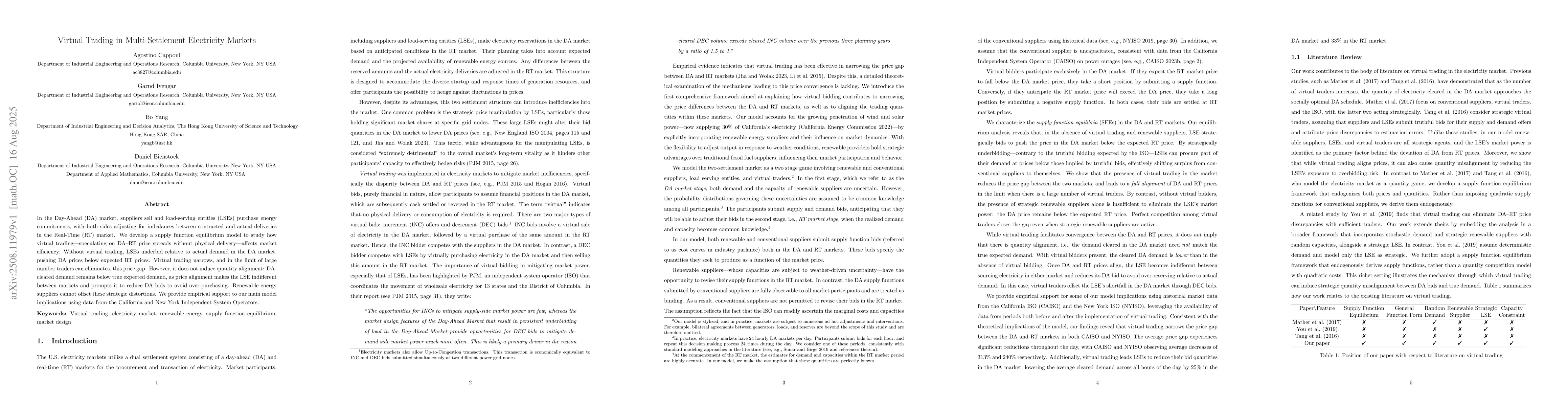

In the Day-Ahead (DA) market, suppliers sell and load-serving entities (LSEs) purchase energy commitments, with both sides adjusting for imbalances between contracted and actual deliveries in the Real-Time (RT) market. We develop a supply function equilibrium model to study how virtual trading-speculating on DA-RT price spreads without physical delivery-affects market efficiency. Without virtual trading, LSEs underbid relative to actual demand in the DA market, pushing DA prices below expected RT prices. Virtual trading narrows, and in the limit of large number traders can eliminates, this price gap. However, it does not induce quantity alignment: DA-cleared demand remains below true expected demand, as price alignment makes the LSE indifferent between markets and prompts it to reduce DA bids to avoid over-purchasing. Renewable energy suppliers cannot offset these strategic distortions. We provide empirical support to our main model implications using data from the California and New York Independent System Operators.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMulti-timescale Trading Strategy for Renewable Power to Ammonia Virtual Power Plant in the Electricity, Hydrogen, and Ammonia Markets

Feng Liu, Yonghua Song, Xiang Cheng et al.

Optimizing Bidding Curves for Renewable Energy in Two-Settlement Electricity Markets

Audun Botterud, Dongwei Zhao, Stefanos Delikaraogloub et al.

Comments (0)