Summary

The volatility characterizes the amplitude of price return fluctuations. It is a central magnitude in finance closely related to the risk of holding a certain asset. Despite its popularity on trading floors, the volatility is unobservable and only the price is known. Diffusion theory has many common points with the research on volatility, the key of the analogy being that volatility is the time-dependent diffusion coefficient of the random walk for the price return. We present a formal procedure to extract volatility from price data, by assuming that it is described by a hidden Markov process which together with the price form a two-dimensional diffusion process. We derive a maximum likelihood estimate valid for a wide class of two-dimensional diffusion processes. The choice of the exponential Ornstein-Uhlenbeck (expOU) stochastic volatility model performs remarkably well in inferring the hidden state of volatility. The formalism is applied to the Dow Jones index. The main results are: (i) the distribution of estimated volatility is lognormal, which is consistent with the expOU model; (ii) the estimated volatility is related to trading volume by a power law of the form $\sigma \propto V^{0.55}$; and (iii) future returns are proportional to the current volatility which suggests some degree of predictability for the size of future returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

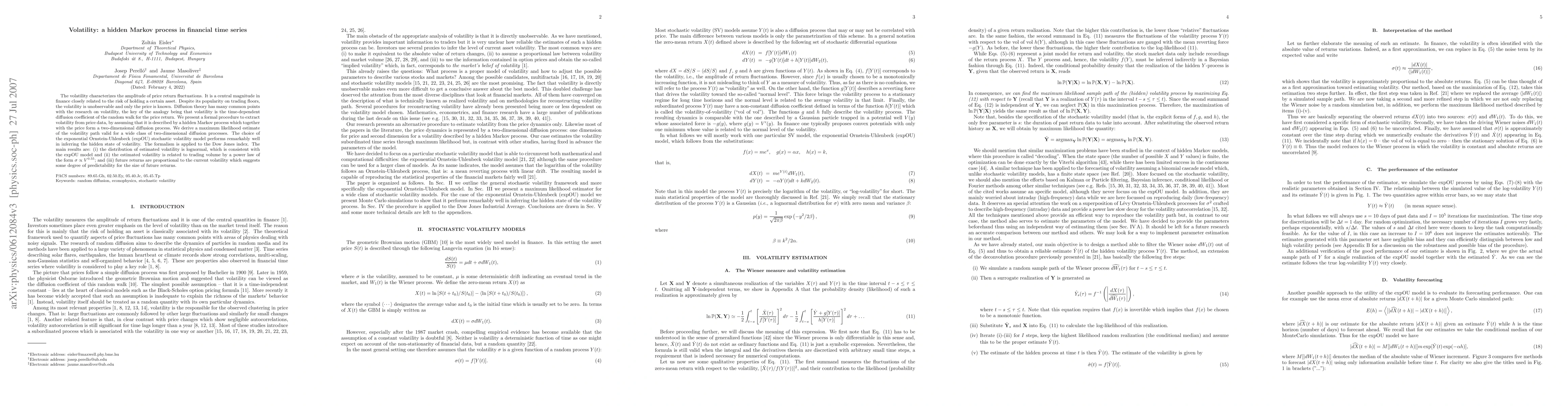

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)