Summary

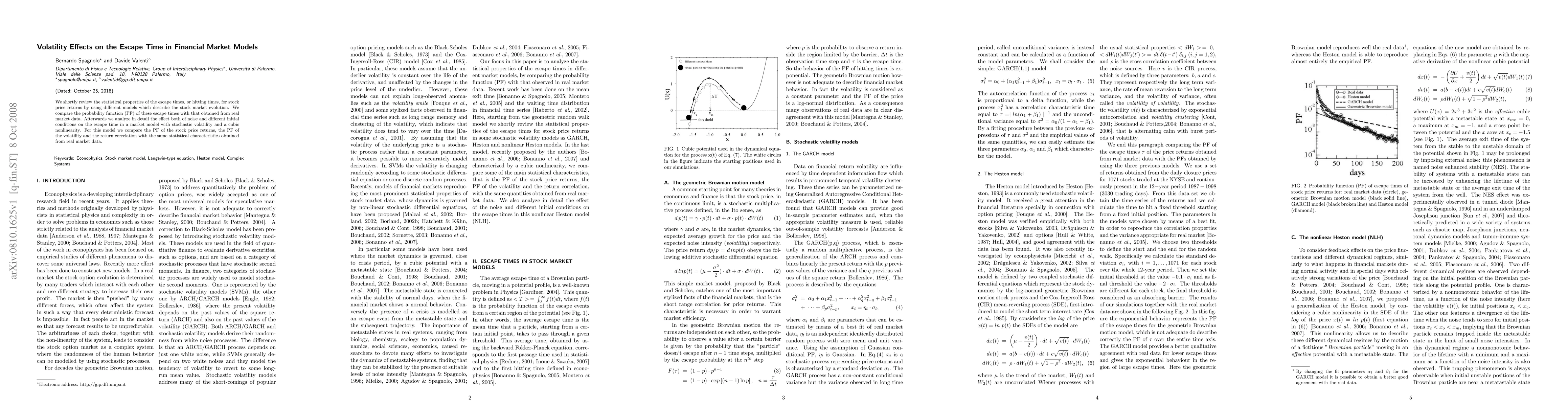

We shortly review the statistical properties of the escape times, or hitting times, for stock price returns by using different models which describe the stock market evolution. We compare the probability function (PF) of these escape times with that obtained from real market data. Afterwards we analyze in detail the effect both of noise and different initial conditions on the escape time in a market model with stochastic volatility and a cubic nonlinearity. For this model we compare the PF of the stock price returns, the PF of the volatility and the return correlation with the same statistical characteristics obtained from real market data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)