Summary

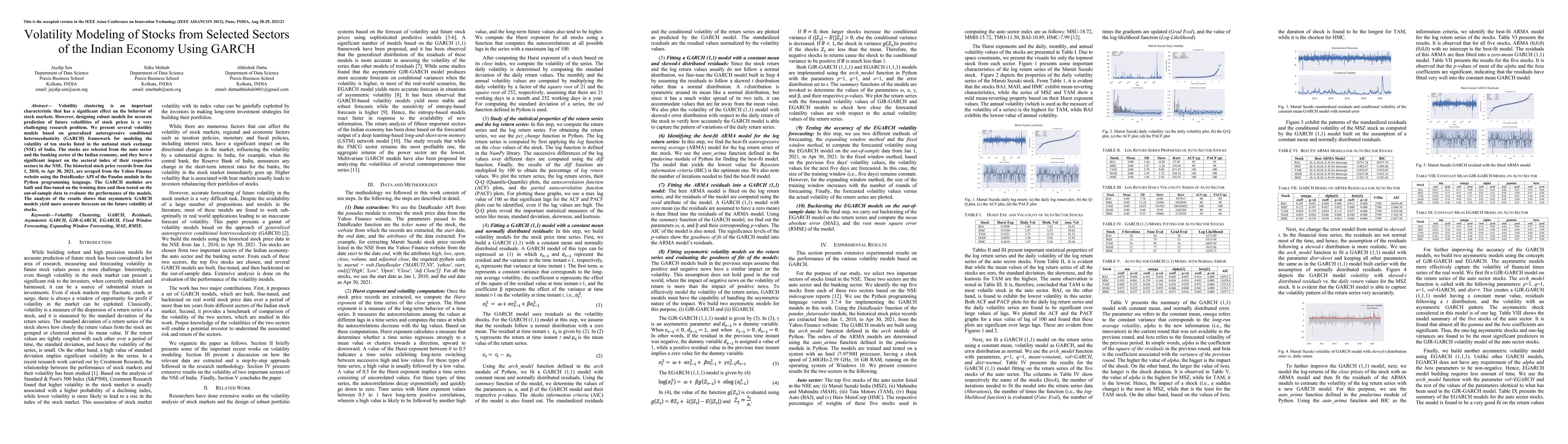

Volatility clustering is an important characteristic that has a significant effect on the behavior of stock markets. However, designing robust models for accurate prediction of future volatilities of stock prices is a very challenging research problem. We present several volatility models based on generalized autoregressive conditional heteroscedasticity (GARCH) framework for modeling the volatility of ten stocks listed in the national stock exchange (NSE) of India. The stocks are selected from the auto sector and the banking sector of the Indian economy, and they have a significant impact on the sectoral index of their respective sectors in the NSE. The historical stock price records from Jan 1, 2010, to Apr 30, 2021, are scraped from the Yahoo Finance website using the DataReader API of the Pandas module in the Python programming language. The GARCH modules are built and fine-tuned on the training data and then tested on the out-of-sample data to evaluate the performance of the models. The analysis of the results shows that asymmetric GARCH models yield more accurate forecasts on the future volatility of stocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStock Performance Evaluation for Portfolio Design from Different Sectors of the Indian Stock Market

Jaydip Sen, Sanket Das, Arpit Awad et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)