Summary

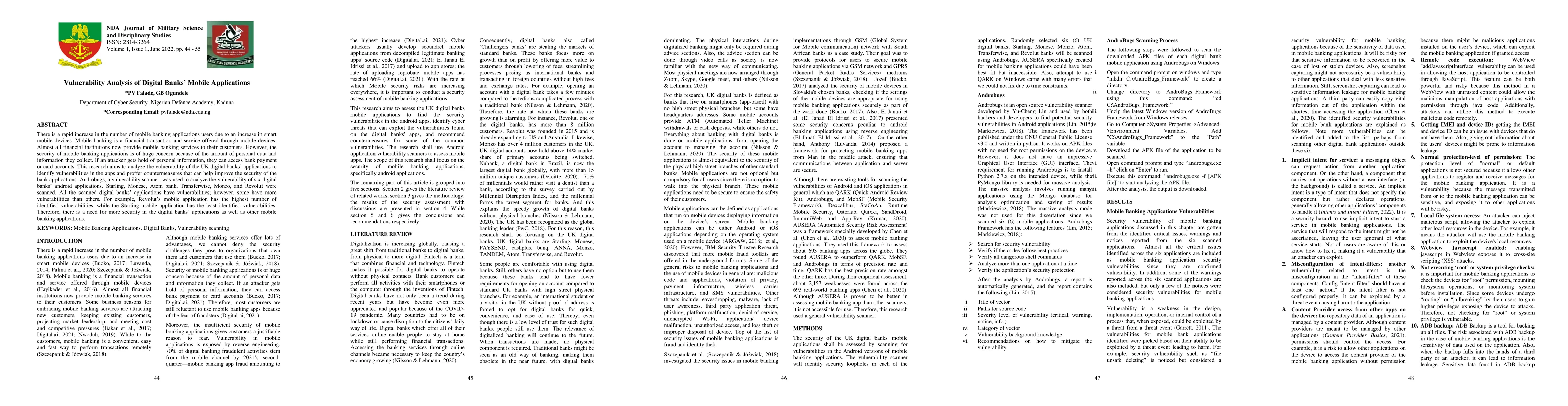

There is a rapid increase in the number of mobile banking applications' users due to an increase in smart mobile devices. Mobile banking is a financial transaction and service offered through mobile devices. Almost all financial institutions now provide mobile banking services to their customers. However, the security of mobile banking applications is of huge concern because of the amount of personal data and information they collect. If an attacker gets hold of personal information, they can access bank payment or card accounts. This research aims to analyze the vulnerability of the UK digital banks' applications to identify vulnerabilities in the apps and proffer countermeasures that can help improve the security of the bank applications. Androbugs, a vulnerability scanner, was used to analyze the vulnerability of six digital banks' android applications. Starling, Monese, Atom bank, Transferwise, Monzo, and Revolut were scanned. All the scanned digital banks' applications have vulnerabilities; however, some have more vulnerabilities than others. For example, Revolut's mobile application has the highest number of identified vulnerabilities. Therefore, there is need for more security in the digital banks' applications as well as other mobile banking applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCentral Bank Digital Currency with Collateral-constrained Banks

Hanfeng Chen, Maria Elena Filippin

Security Analysis of Mobile Banking Application in Qatar

Shaymaa Abdulla Al-Delayel

| Title | Authors | Year | Actions |

|---|

Comments (0)