Summary

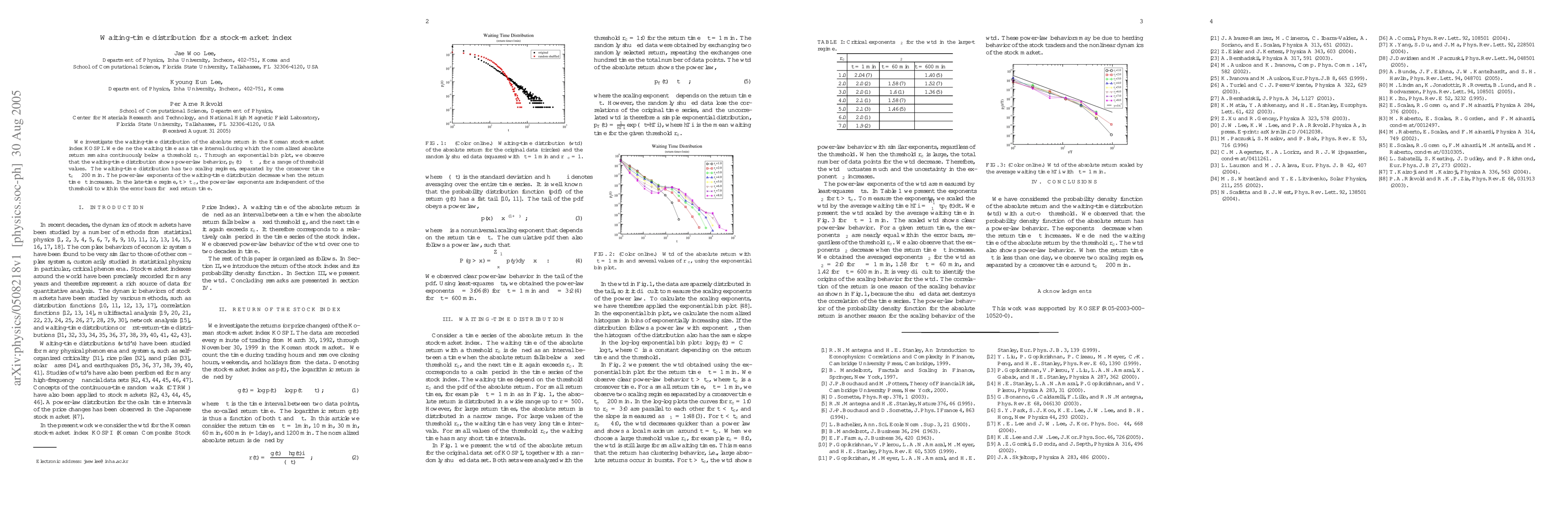

We investigate the waiting-time distribution of the absolute return in the Korean stock-market index KOSPI. We define the waiting time as a time interval during which the normalized absolute return remains continuously below a threshold $r_c$. Through an exponential bin plot, we observe that the waiting-time distribution shows power-law behavior, $p_f (t) \sim t^{-\beta}$, for a range of threshold values. The waiting-time distribution has two scaling regimes, separated by the crossover time $t_c \approx 200$ min. The power-law exponents of the waiting-time distribution decrease when the return time $\Delta t$ increases. In the late-time regime, $t > t_c$, the power-law exponents are independent of the threshold to within the error bars for fixed return time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersPrecision measurement of the return distribution property of the Chinese stock market index

Peng Liu, Yanyan Zheng

Comments (0)