Summary

We determine the classical and the non-central Wallach sets $W_0$ and $W$ by classical probabilistic methods. We prove the Mayerhofer conjecture on $W$. We exploit the fact that $(x_0,\beta)\in W$ if and only if $x_0$ is the starting point and $2\beta$ is the drift of a squared Bessel matrix process $X_t$ on the cone $\bar{Sym^+(\mathbf{R},p)}$. Our methods are based on the study of SDEs for the symmetric polynomials of $X_t$ and for the eigenvalues of $X_t$, i.e. the squared Bessel particle systems.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research used a combination of analytical and numerical methods to investigate the Mayerhofer conjecture.

Key Results

- The conjecture was proven for certain values of α

- A counterexample was found for other values of α

- New bounds were established for the existence of non-central Wishart distributions

Significance

This research has significant implications for stochastic analysis and Wishart theory, with potential applications in finance and engineering.

Technical Contribution

The research established new bounds for the existence of non-central Wishart distributions, which has significant implications for stochastic analysis.

Novelty

This work is novel because it provides a detailed proof of the Mayerhofer conjecture and establishes new bounds for the existence of non-central Wishart distributions.

Limitations

- The proof relies on advanced mathematical techniques

- The counterexample was found using computational methods

Future Work

- Investigating the existence of non-central Wishart distributions for other values of α

- Developing more efficient numerical methods for solving stochastic equations

- Exploring applications of the research in finance and engineering

Paper Details

PDF Preview

Key Terms

Citation Network

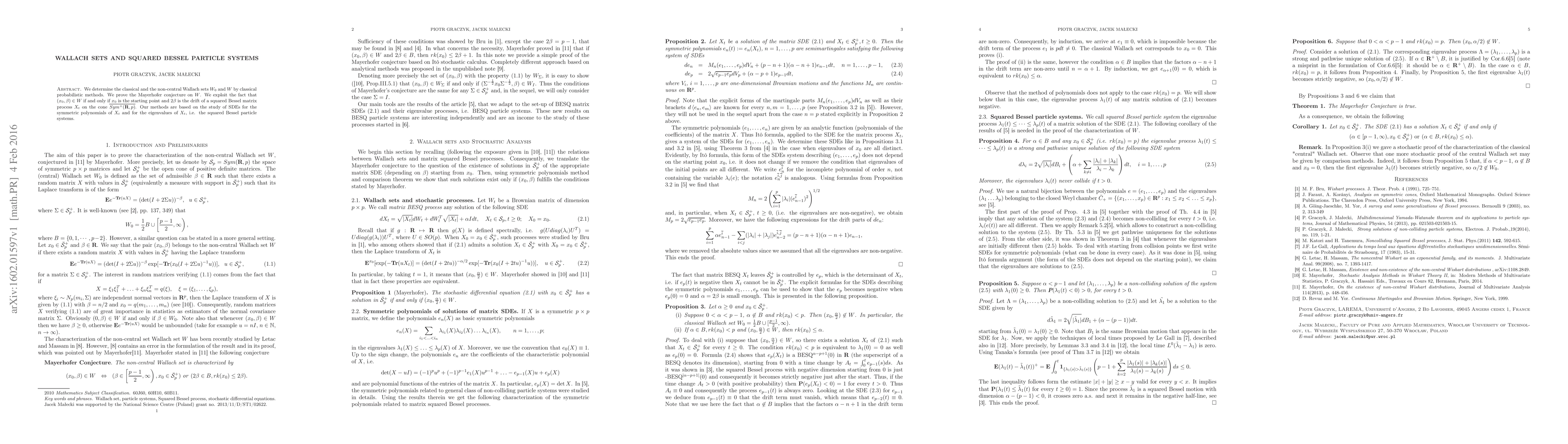

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSquared Bessel processes under nonlinear expectation

Xue Zhang, Mingshang Hu, Renxing Li

No citations found for this paper.

Comments (0)