Summary

In a multi-unit market, a seller brings multiple units of a good and tries to sell them to a set of buyers that have monetary endowments. While a Walrasian equilibrium does not always exist in this model, natural relaxations of the concept that retain its desirable fairness properties do exist. We study the dynamics of (Walrasian) envy-free pricing mechanisms in this environment, showing that for any such pricing mechanism, the best response dynamic starting from truth-telling converges to a pure Nash equilibrium with small loss in revenue and welfare. Moreover, we generalize these bounds to capture all the Nash equilibria for a large class of (monotone) pricing mechanisms. We also identify a natural mechanism, which selects the minimum Walrasian envy-free price, in which for $n=2$ buyers the best response dynamic converges from any starting profile, and for which we conjecture convergence for any number of buyers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

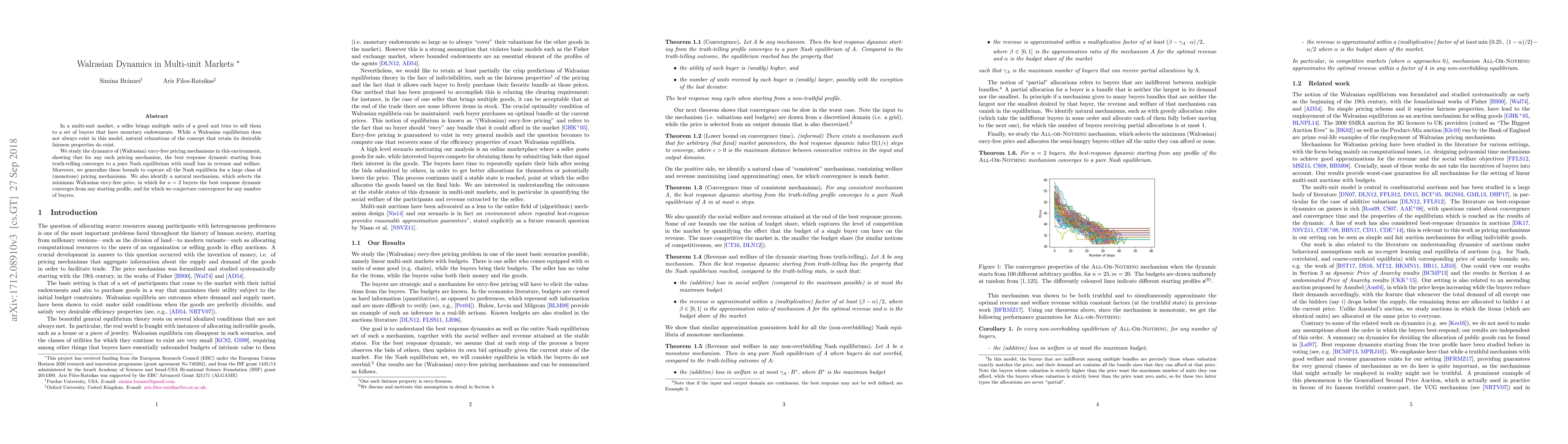

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)