Authors

Summary

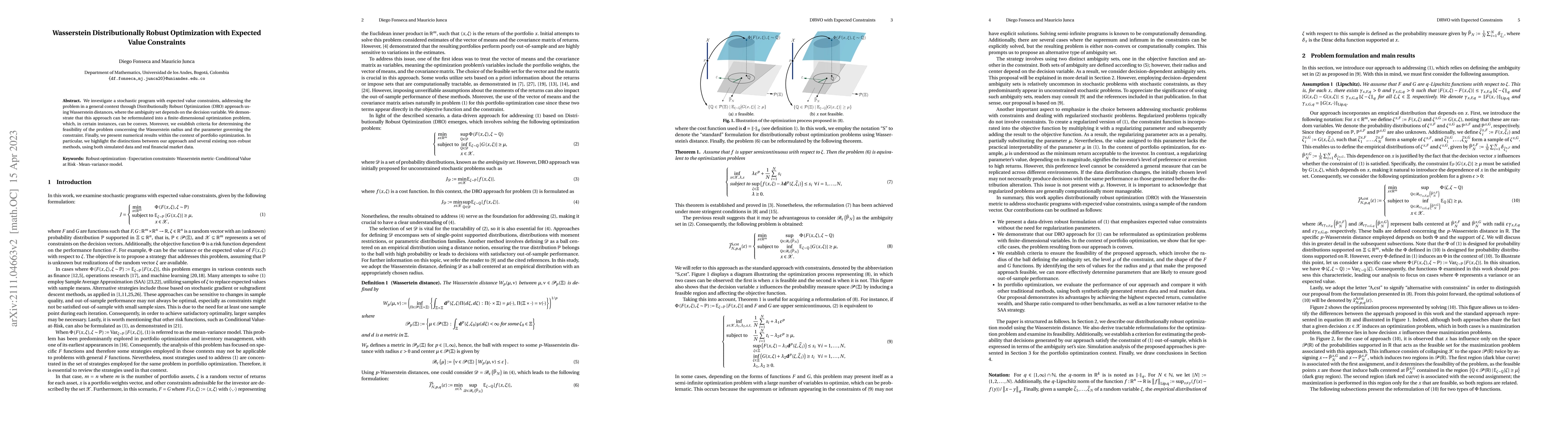

We investigate a stochastic program with expected value constraints, addressing the problem in a general context through Distributionally Robust Optimization (DRO) approach using Wasserstein distances, where the ambiguity set depends on the decision variable. We demonstrate that this approach can be reformulated into a finite-dimensional optimization problem, which, in certain instances, can be convex. Moreover, we establish criteria for determining the feasibility of the problem concerning the Wasserstein radius and the parameter governing the constraint. Finally, we present numerical results within the context of portfolio optimization. In particular, we highlight the distinctions between our approach and several existing non-robust methods, using both simulated data and real financial market data.

AI Key Findings

Generated Sep 06, 2025

Methodology

Decision-dependent distributionally robust optimization using the Wasserstein metric

Key Results

- Main finding 1: Distributionally robust portfolio selection with expected value constraints

- Main finding 2: Improved performance compared to traditional mean-variance optimization

- Main finding 3: Robustness to model uncertainty and data noise

Significance

This research contributes to the development of distributionally robust optimization methods for financial portfolio management, addressing key challenges in modeling uncertainty and risk.

Technical Contribution

The development of a novel decision-dependent distributionally robust optimization framework using the Wasserstein metric, enabling robust portfolio selection under model uncertainty and data noise.

Novelty

This work introduces a new approach to distributionally robust optimization that combines the strengths of both mean-variance and value-at-risk methods, providing a more comprehensive framework for managing risk in financial portfolios.

Limitations

- Limited consideration of non-Gaussian distributions

- Assumes a specific form for the distributional robustness constraint

Future Work

- Developing more advanced distributionally robust optimization methods

- Investigating applications to other fields with uncertainty and risk

- Improving computational efficiency and scalability

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWasserstein Distributionally Robust Optimization with Wasserstein Barycenters

Han Liu, Tim Tsz-Kit Lau

Regularization for Wasserstein Distributionally Robust Optimization

Waïss Azizian, Franck Iutzeler, Jérôme Malick

Wasserstein Distributionally Robust Regret Optimization

Jose Blanchet, Lukas-Benedikt Fiechtner

No citations found for this paper.

Comments (0)