Summary

We propose a unified analysis of a whole spectrum of no-arbitrage conditions for financial market models based on continuous semimartingales. In particular, we focus on no-arbitrage conditions weaker than the classical notions of No Arbitrage and No Free Lunch with Vanishing Risk. We provide a complete characterisation of the considered no-arbitrage conditions, linking their validity to the characteristics of the discounted asset price process and to the existence and the properties of (weak) martingale deflators, and review classical as well as recent results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

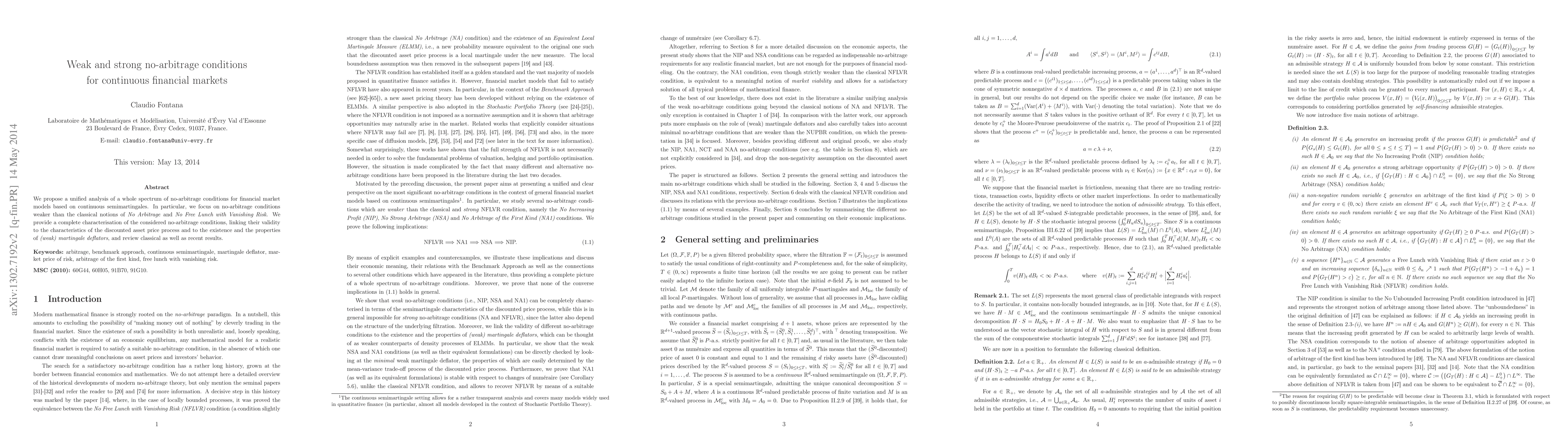

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo-arbitrage conditions and pricing from discrete-time to continuous-time strategies

Dorsaf Cherif, Emmanuel Lepinette

| Title | Authors | Year | Actions |

|---|

Comments (0)