Summary

We provide explicit approximation formulas for VIX futures and options in forward variance models, with particular emphasis on the family of so-called Bergomi models: the one-factor Bergomi model [Bergomi, Smile dynamics II, Risk, 2005], the rough Bergomi model [Bayer, Friz, and Gatheral, Pricing under rough volatility, Quantitative Finance, 16(6):887-904, 2016], and an enhanced version of the rough model that can generate realistic positive skew for VIX smiles -- introduced simultaneously by De Marco [Bachelier World Congress, 2018] and Guyon [Bachelier World Congress, 2018] on the lines of [Bergomi, Smile dynamics III, Risk, 2008], that we refer to as 'mixed rough Bergomi model'. Following the methodology set up in [Gobet and Miri, Weak approximation of averaged diffusion processes. Stochastic Process.\ Appl., 124(1):475-504, 2014], we derive weak approximations for the law of the VIX, leading to option price approximations under the form of explicit combinations of Black-Scholes prices and greeks. As new contributions, we cope with the fractional integration kernel appearing in rough models and treat the case of non-smooth payoffs, so to encompass VIX futures, call and put options. We stress that our approach does not rely on small-time asymptotics nor small-parameter (such as small volatility-of-volatility) asymptotics, and can therefore be applied to any option maturity and a wide range of parameter configurations. Our results are illustrated by several numerical experiments and calibration tests to VIX market data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

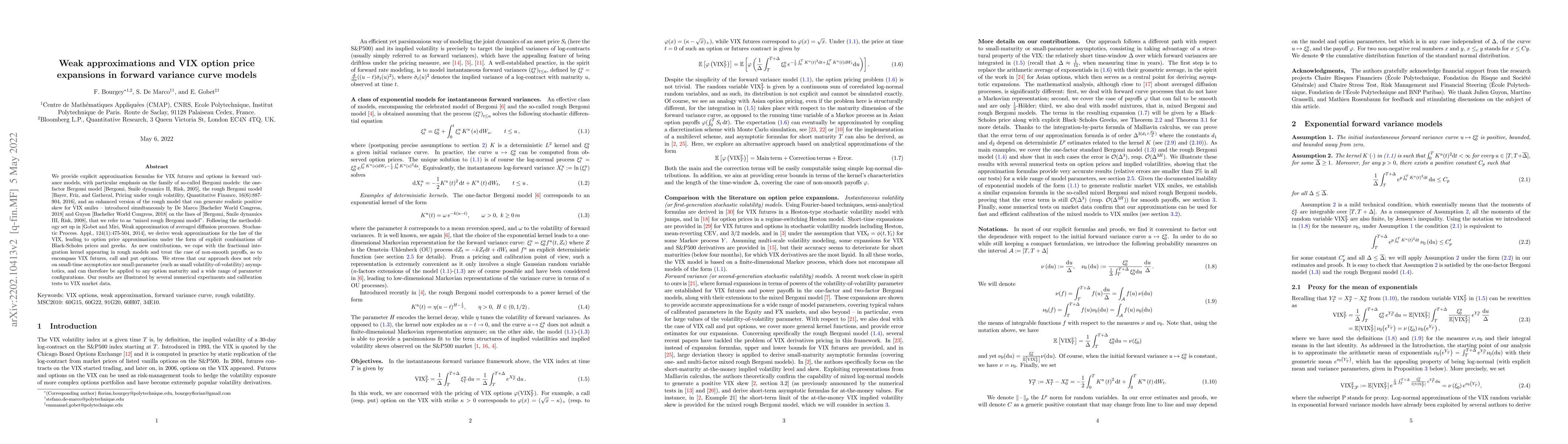

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)