Summary

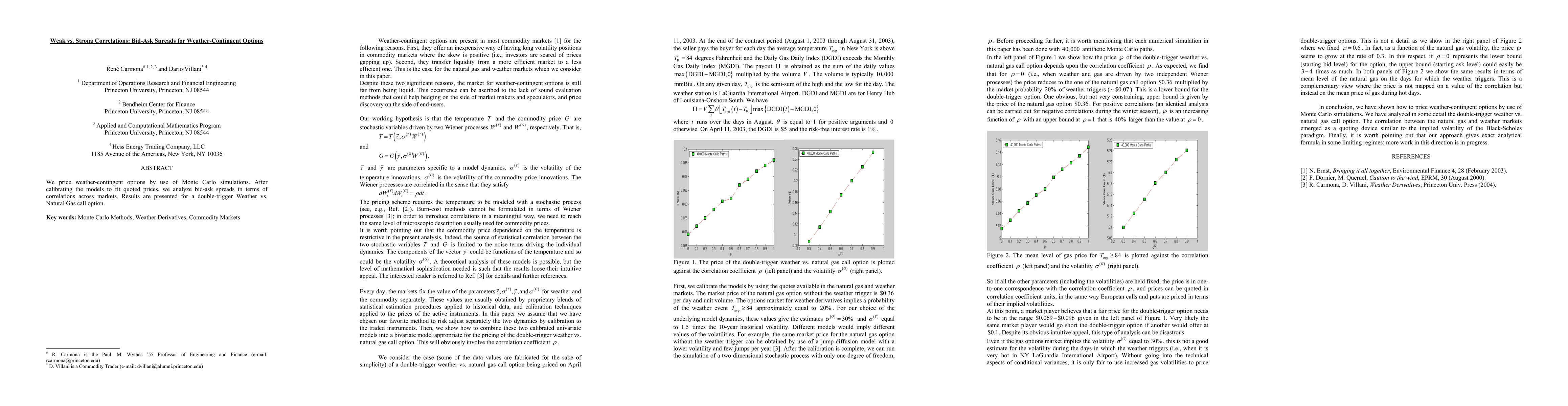

We price weather-contingent options by use of Monte Carlo simulations. After calibrating the models to fit quoted prices, we analyze bid-ask spreads in terms of correlations across markets. Results are presented for a double-trigger Weather vs. Natural Gas call option.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)