Summary

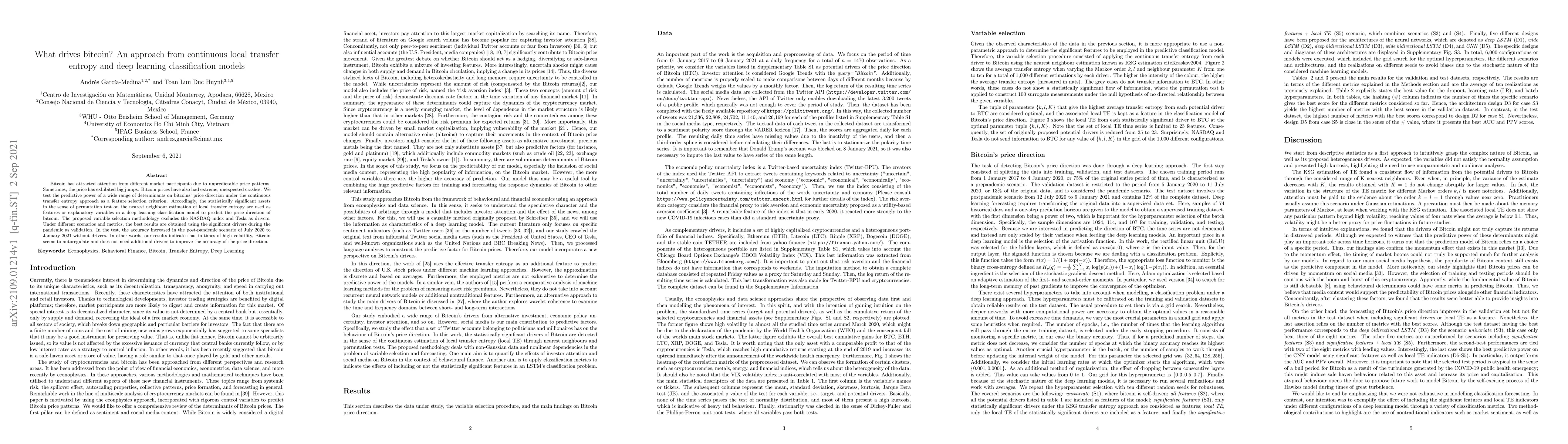

Bitcoin has attracted attention from different market participants due to unpredictable price patterns. Sometimes, the price has exhibited big jumps. Bitcoin prices have also had extreme, unexpected crashes. We test the predictive power of a wide range of determinants on bitcoins' price direction under the continuous transfer entropy approach as a feature selection criterion. Accordingly, the statistically significant assets in the sense of permutation test on the nearest neighbour estimation of local transfer entropy are used as features or explanatory variables in a deep learning classification model to predict the price direction of bitcoin. The proposed variable selection methodology excludes the NASDAQ index and Tesla as drivers. Under different scenarios and metrics, the best results are obtained using the significant drivers during the pandemic as validation. In the test, the accuracy increased in the post-pandemic scenario of July 2020 to January 2021 without drivers. In other words, our results indicate that in times of high volatility, Bitcoin seems to autoregulate and does not need additional drivers to improve the accuracy of the price direction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransfer learning of many-body electronic correlation entropy from local measurements

Jose L. Lado, Teemu Ojanen, Faluke Aikebaier

Transfer learning and Local interpretable model agnostic based visual approach in Monkeypox Disease Detection and Classification: A Deep Learning insights

Kishor Datta Gupta, Md Shahin Ali, Md Manjurul Ahsan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)