Authors

Summary

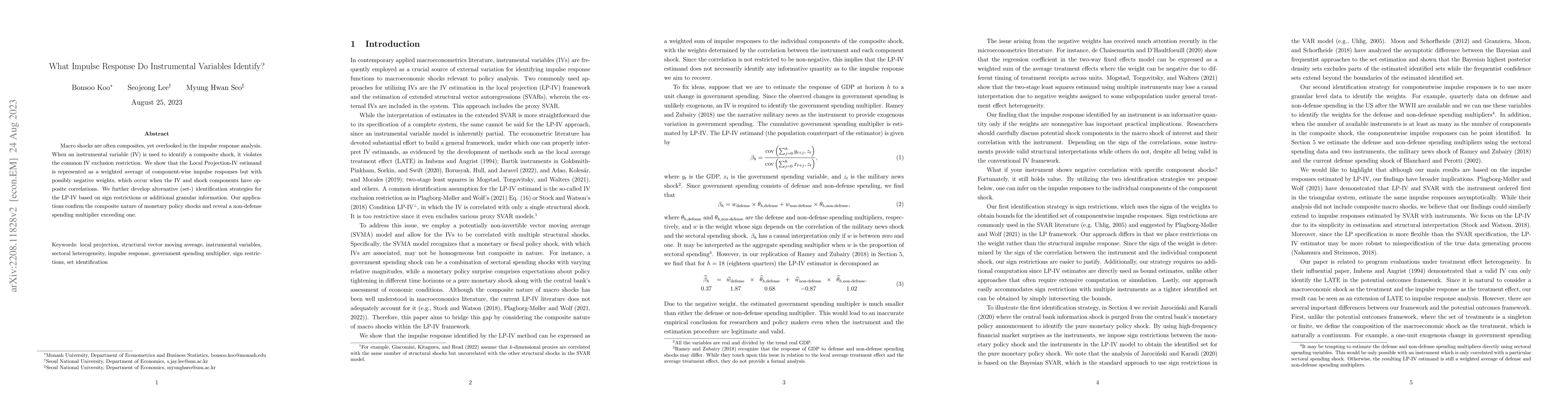

Macro shocks are often composites, yet overlooked in the impulse response analysis. When an instrumental variable (IV) is used to identify a composite shock, it violates the common IV exclusion restriction. We show that the Local Projection-IV estimand is represented as a weighted average of component-wise impulse responses but with possibly negative weights, which occur when the IV and shock components have opposite correlations. We further develop alternative (set-) identification strategies for the LP-IV based on sign restrictions or additional granular information. Our applications confirm the composite nature of monetary policy shocks and reveal a non-defense spending multiplier exceeding one.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)