Authors

Summary

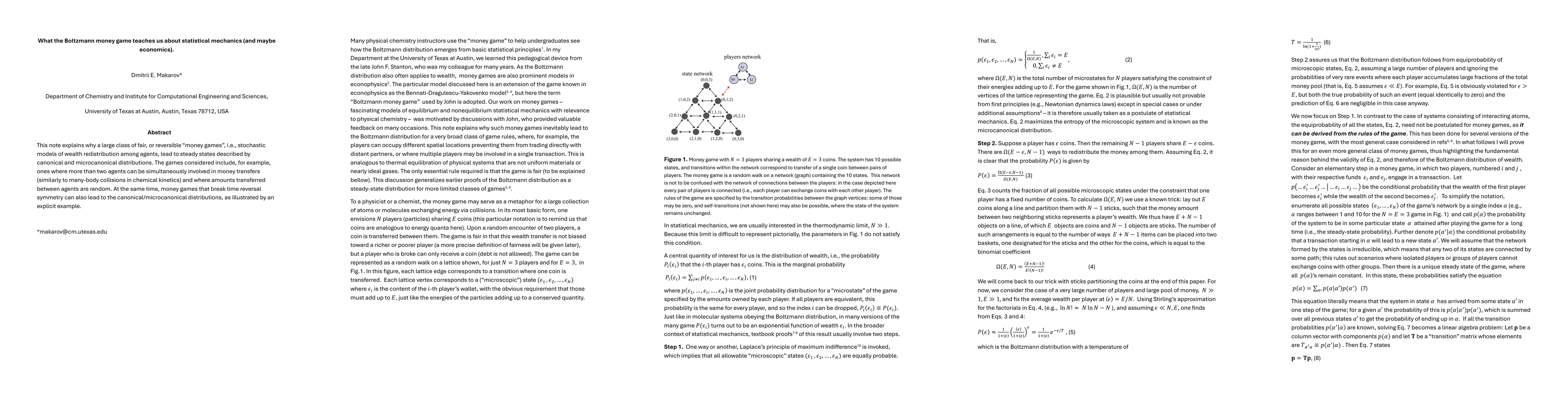

This note explains why a large class of fair, or reversible "money games", i.e., stochastic models of wealth redistribution among agents, lead to steady states described by canonical and microcanonical distributions. The games considered include, for example, ones where more than two agents can be simultaneously involved in money transfers (similarly to many-body collisions in chemical kinetics) and where amounts transferred between agents are random. At the same time, money games that break time reversal symmetry can also lead to the canonical/microcanonical distributions, as illustrated by an explicit example.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNonequilibrium statistical mechanics of money/energy exchange models

Dmitrii E. Makarov, Kristian Blom, Maggie Miao

No citations found for this paper.

Comments (0)