Summary

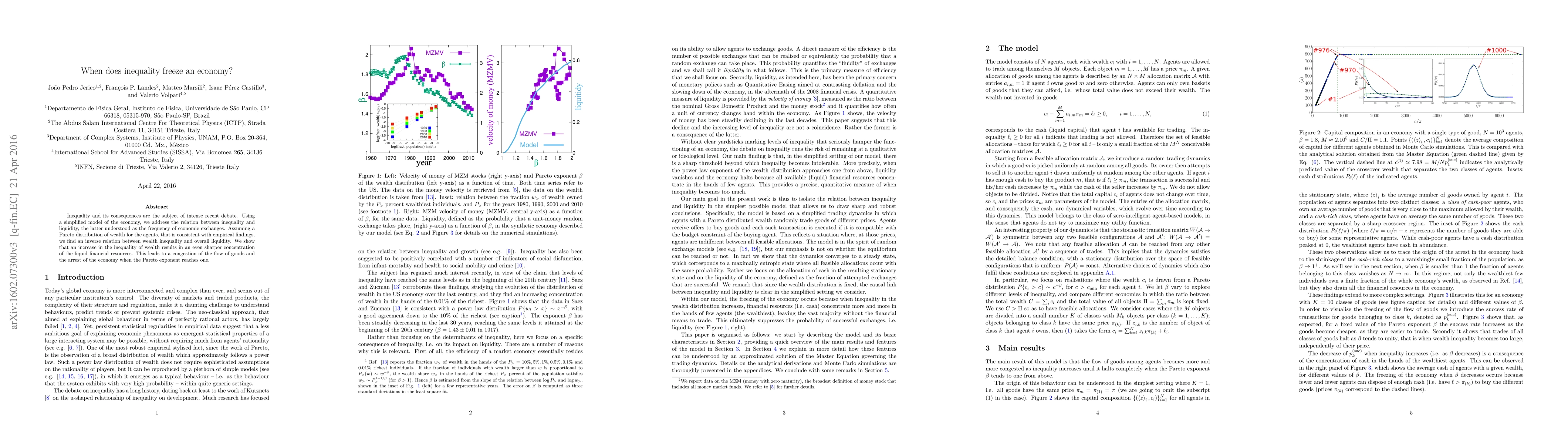

Inequality and its consequences are the subject of intense recent debate. Using a simplified model of the economy, we address the relation between inequality and liquidity, the latter understood as the frequency of economic exchanges. Assuming a Pareto distribution of wealth for the agents, that is consistent with empirical findings, we find an inverse relation between wealth inequality and overall liquidity. We show that an increase in the inequality of wealth results in an even sharper concentration of the liquid financial resources. This leads to a congestion of the flow of goods and the arrest of the economy when the Pareto exponent reaches one.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInequality in a model of capitalist economy

Celia Anteneodo, Sebastian Gonçalves, Jhordan Silveira Borba

| Title | Authors | Year | Actions |

|---|

Comments (0)