Summary

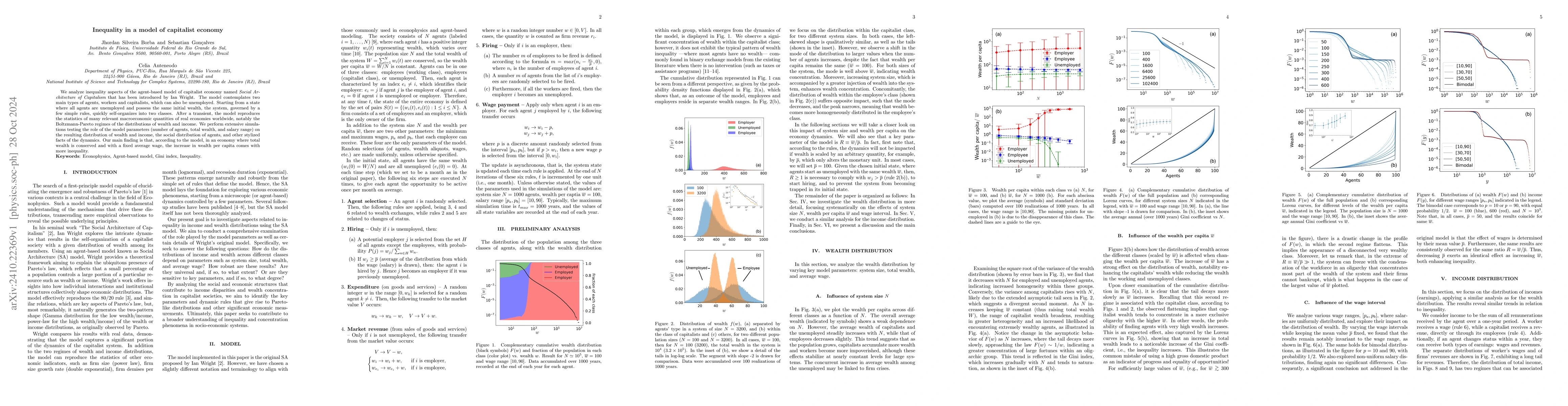

We analyze inequality aspects of the agent-based model of capitalist economy named it Social Architecture of Capitalism that has been introduced by Ian Wright. The model contemplates two main types of agents, workers and capitalists, which can also be unemployed. Starting from a state where all agents are unemployed and possess the same initial wealth, the system, governed by a few simple rules, quickly self-organizes into two classes. After a transient, the model reproduces the statistics of many relevant macroeconomic quantities of real economies worldwide, notably the Boltzmann-Pareto regimes of the distributions of wealth and income. We perform extensive simulations testing the role of the model parameters (number of agents, total wealth, and salary range) on the resulting distribution of wealth and income, the social distribution of agents, and other stylized facts of the dynamics. Our main finding is that, according to the model, in an economy where total wealth is conserved and with a fixed average wage, the increase in wealth per capita comes with more inequality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIslamic and capitalist economies: Comparison using econophysics models of wealth exchange and redistribution

Takeshi Kato

AI Regulation and Capitalist Growth: Balancing Innovation, Ethics, and Global Governance

Deepti Gupta, Vikram Kulothungan, Priya Ranjani Mohan

No citations found for this paper.

Comments (0)