Summary

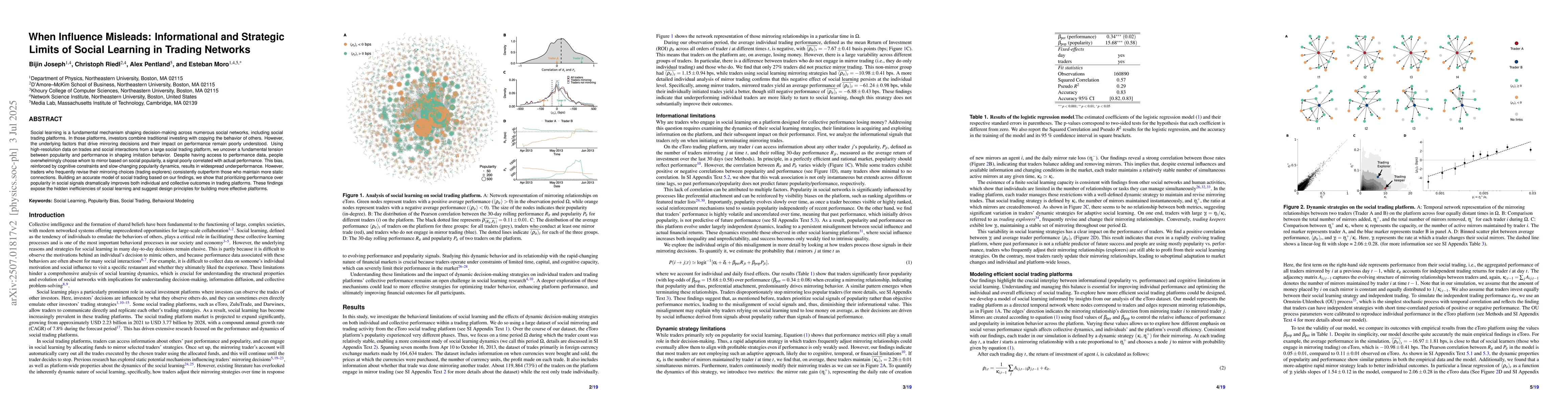

Social learning is a fundamental mechanism shaping decision-making across numerous social networks, including social trading platforms. In those platforms, investors combine traditional investing with copying the behavior of others. However, the underlying factors that drive mirroring decisions and their impact on performance remain poorly understood. Using high-resolution data on trades and social interactions from a large social trading platform, we uncover a fundamental tension between popularity and performance in shaping imitation behavior. Despite having access to performance data, people overwhelmingly choose whom to mirror based on social popularity, a signal poorly correlated with actual performance. This bias, reinforced by cognitive constraints and slow-changing popularity dynamics, results in widespread underperformance. However, traders who frequently revise their mirroring choices (trading explorers) consistently outperform those who maintain more static connections. Building an accurate model of social trading based on our findings, we show that prioritizing performance over popularity in social signals dramatically improves both individual and collective outcomes in trading platforms. These findings expose the hidden inefficiencies of social learning and suggest design principles for building more effective platforms.

AI Key Findings

Generated Sep 03, 2025

Methodology

The study utilizes high-resolution trade and social interaction data from a large social trading platform, employing a dynamical social learning model to analyze traders' mirroring decisions and their impact on performance.

Key Results

- A fundamental tension exists between popularity and performance in shaping imitation behavior, with traders overwhelmingly choosing to mirror based on social popularity rather than actual performance.

- Traders who frequently revise their mirroring choices (trading explorers) consistently outperform those who maintain static connections.

- Prioritizing performance over popularity in social signals dramatically improves both individual and collective outcomes in trading platforms.

- The findings expose hidden inefficiencies of social learning and suggest design principles for more effective platforms.

- The dynamics observed extend beyond finance, affecting digital environments where popularity metrics heavily influence user behavior, often at the expense of content quality or informational accuracy.

Significance

This research is important as it uncovers the inefficiencies of social learning in trading networks, providing insights applicable to various social networks and decision-making environments, including finance, social media, and political discourse.

Technical Contribution

The paper proposes a dynamical social learning model that captures the interplay between informational factors (popularity and performance) and limited-capacity, dynamic strategies adopted by traders on social learning platforms.

Novelty

The research distinguishes itself by uncovering the hidden inefficiencies of social learning in trading networks, emphasizing the discrepancy between social popularity and actual performance, and providing design principles for more effective platforms.

Limitations

- The study focuses on a relatively short time frame (August 2010 to December 2013) and does not incorporate heterogeneous utility functions or bounded rationality.

- The analysis does not cover extreme conditions like market crashes or longer periods of social learning dynamics.

- Data is limited to one social trading platform, and generalizability to other platforms or contexts may vary.

Future Work

- Investigate how social learning dynamics interact with varying market structures, algorithmic recommendation systems, and behavioral heterogeneity.

- Explore the broader implications of these findings in other socially-mediated decision environments, such as political discourse and content recommendation systems.

- Develop and test design principles for platforms that support adaptive social learning while mitigating the distortive effects of popularity-based signals.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStrategic Learning and Trading in Broker-Mediated Markets

Fayçal Drissi, Leandro Sánchez-Betancourt, Alif Aqsha

No citations found for this paper.

Comments (0)