Summary

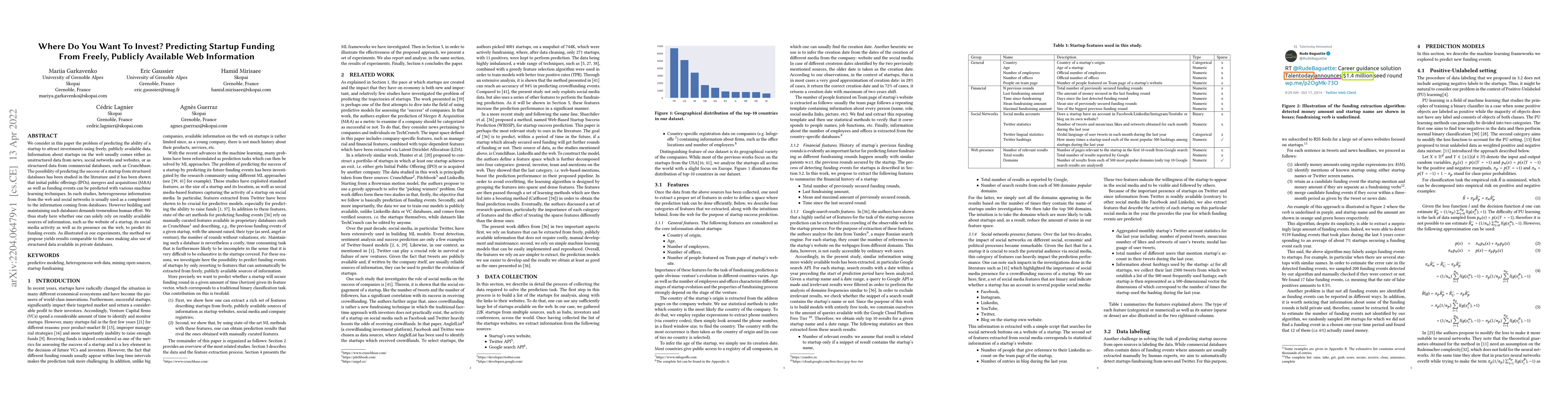

We consider in this paper the problem of predicting the ability of a startup to attract investments using freely, publicly available data. Information about startups on the web usually comes either as unstructured data from news, social networks, and websites or as structured data from commercial databases, such as Crunchbase. The possibility of predicting the success of a startup from structured databases has been studied in the literature and it has been shown that initial public offerings (IPOs), mergers and acquisitions (M\&A) as well as funding events can be predicted with various machine learning techniques. In such studies, heterogeneous information from the web and social networks is usually used as a complement to the information coming from databases. However, building and maintaining such databases demands tremendous human effort. We thus study here whether one can solely rely on readily available sources of information, such as the website of a startup, its social media activity as well as its presence on the web, to predict its funding events. As illustrated in our experiments, the method we propose yields results comparable to the ones making also use of structured data available in private databases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)