Summary

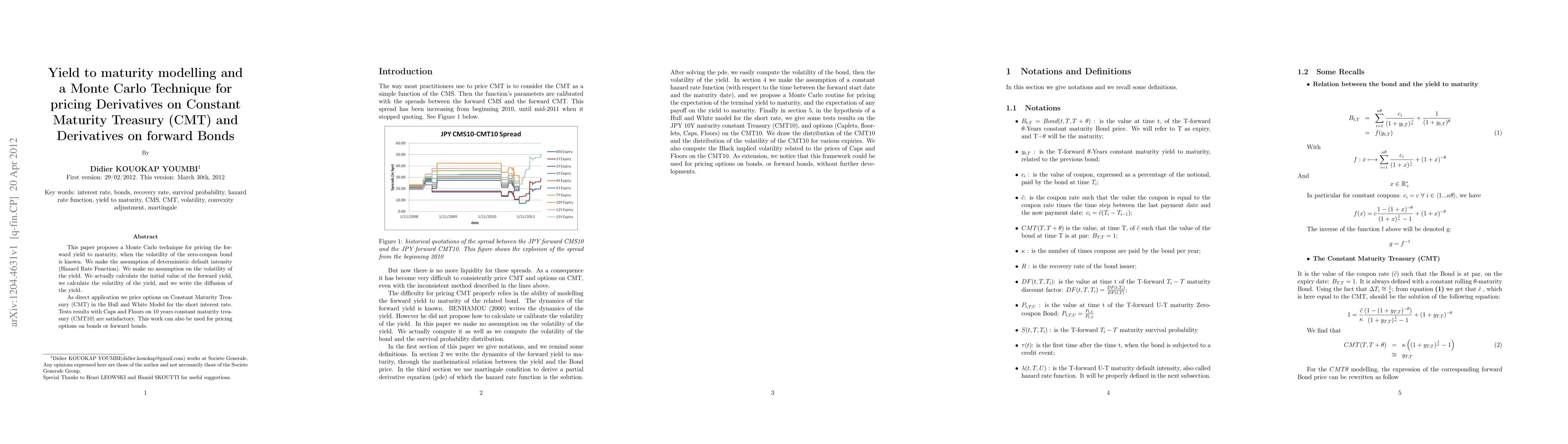

This paper proposes a Monte Carlo technique for pricing the forward yield to maturity, when the volatility of the zero-coupon bond is known. We make the assumption of deterministic default intensity (Hazard Rate Function). We make no assumption on the volatility of the yield. We actually calculate the initial value of the forward yield, we calculate the volatility of the yield, and we write the diffusion of the yield. As direct application we price options on Constant Maturity Treasury (CMT) in the Hull and White Model for the short interest rate. Tests results with Caps and Floors on 10 years constant maturity treasury (CMT10) are satisfactory. This work can also be used for pricing options on bonds or forward bonds.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)