Authors

Summary

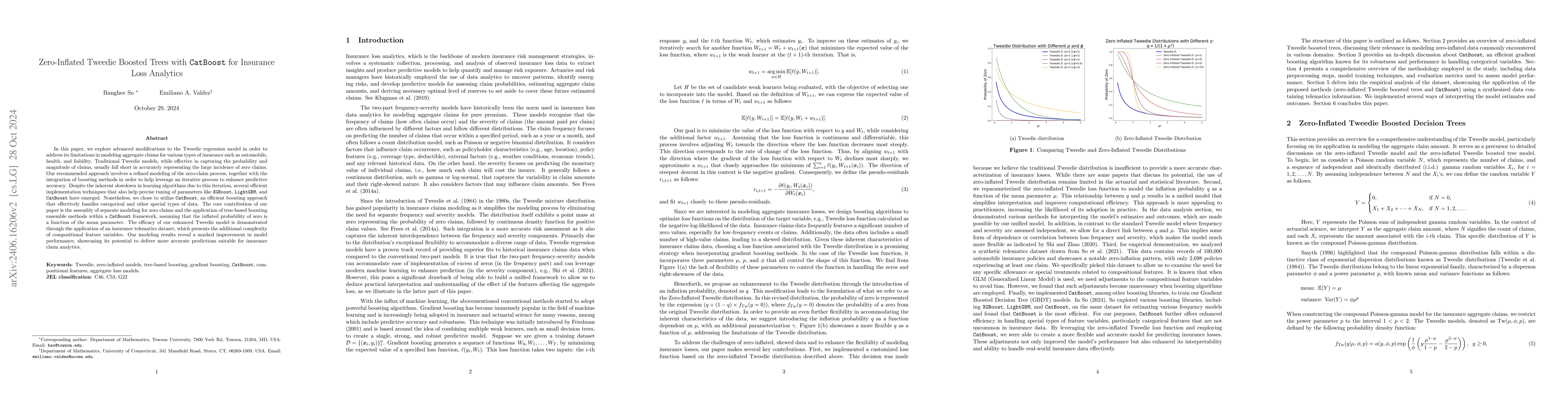

In this paper, we explore advanced modifications to the Tweedie regression model in order to address its limitations in modeling aggregate claims for various types of insurance such as automobile, health, and liability. Traditional Tweedie models, while effective in capturing the probability and magnitude of claims, usually fall short in accurately representing the large incidence of zero claims. Our recommended approach involves a refined modeling of the zero-claim process, together with the integration of boosting methods in order to help leverage an iterative process to enhance predictive accuracy. Despite the inherent slowdown in learning algorithms due to this iteration, several efficient implementation techniques that also help precise tuning of parameter like XGBoost, LightGBM, and CatBoost have emerged. Nonetheless, we chose to utilize CatBoost, a efficient boosting approach that effectively handles categorical and other special types of data. The core contribution of our paper is the assembly of separate modeling for zero claims and the application of tree-based boosting ensemble methods within a CatBoost framework, assuming that the inflated probability of zero is a function of the mean parameter. The efficacy of our enhanced Tweedie model is demonstrated through the application of an insurance telematics dataset, which presents the additional complexity of compositional feature variables. Our modeling results reveal a marked improvement in model performance, showcasing its potential to deliver more accurate predictions suitable for insurance claim analytics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)