Authors

Summary

We consider a finite-horizon, zero-sum game in which both players control a stochastic differential equation by invoking impulses. We derive a control randomization formulation of the game and use the existence of a value for the randomized game to show that the upper and lower value functions of the original game coincide. The main contribution of the present work is that we can allow intervention costs that are functions of the state as well as time, and that we do not need to impose any monotonicity assumptions on the involved coefficients.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research employs a finite-horizon, zero-sum game framework where both players control a stochastic differential equation via impulse interventions.

Key Results

- Derivation of a control randomization formulation for the game

- Demonstration that upper and lower value functions of the original game coincide

Significance

This work allows for intervention costs that are state- and time-dependent without imposing monotonicity assumptions, broadening the applicability of stochastic differential games.

Technical Contribution

The introduction of a control randomization formulation for zero-sum stochastic differential games with impulse control and random intervention costs

Novelty

The research relaxes monotonicity assumptions on coefficients, extending the scope of existing literature on such games

Limitations

- The paper focuses on a finite-horizon game; extensions to infinite-horizon games are not explored

- Specific numerical or practical applications of the results are not provided

Future Work

- Investigate infinite-horizon versions of the game

- Explore practical applications in finance, economics, or engineering

Paper Details

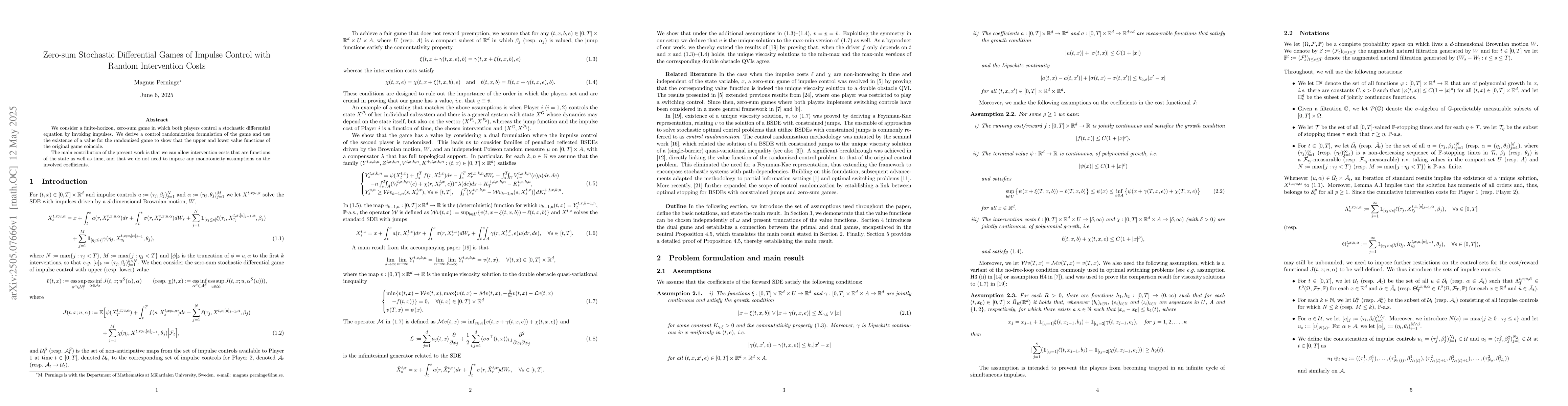

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)