Arno Botha

8 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

The TruEnd-procedure: Treating trailing zero-valued balances in credit data

A novel procedure is presented for finding the true but latent endpoints within the repayment histories of individual loans. The monthly observations beyond these true endpoints are false, largely d...

Defining and comparing SICR-events for classifying impaired loans under IFRS 9

The IFRS 9 accounting standard requires the prediction of credit deterioration in financial instruments, i.e., significant increases in credit risk (SICR). However, the definition of such a SICR-eve...

The loss optimisation of loan recovery decision times using forecast cash flows

A theoretical method is empirically illustrated in finding the best time to forsake a loan such that the overall credit loss is minimised. This is predicated by forecasting the future cash flows of ...

Simulation-based optimisation of the timing of loan recovery across different portfolios

A novel procedure is presented for the objective comparison and evaluation of a bank's decision rules in optimising the timing of loan recovery. This procedure is based on finding a delinquency thre...

Modelling the term-structure of default risk under IFRS 9 within a multistate regression framework

The lifetime behaviour of loans is notoriously difficult to model, which can compromise a bank's financial reserves against future losses, if modelled poorly. Therefore, we present a data-driven compa...

Towards modelling lifetime default risk: Exploring different subtypes of recurrent event Cox-regression models

In the pursuit of modelling a loan's probability of default (PD) over its lifetime, repeat default events are often ignored when using Cox Proportional Hazard (PH) models. Excluding such events may pr...

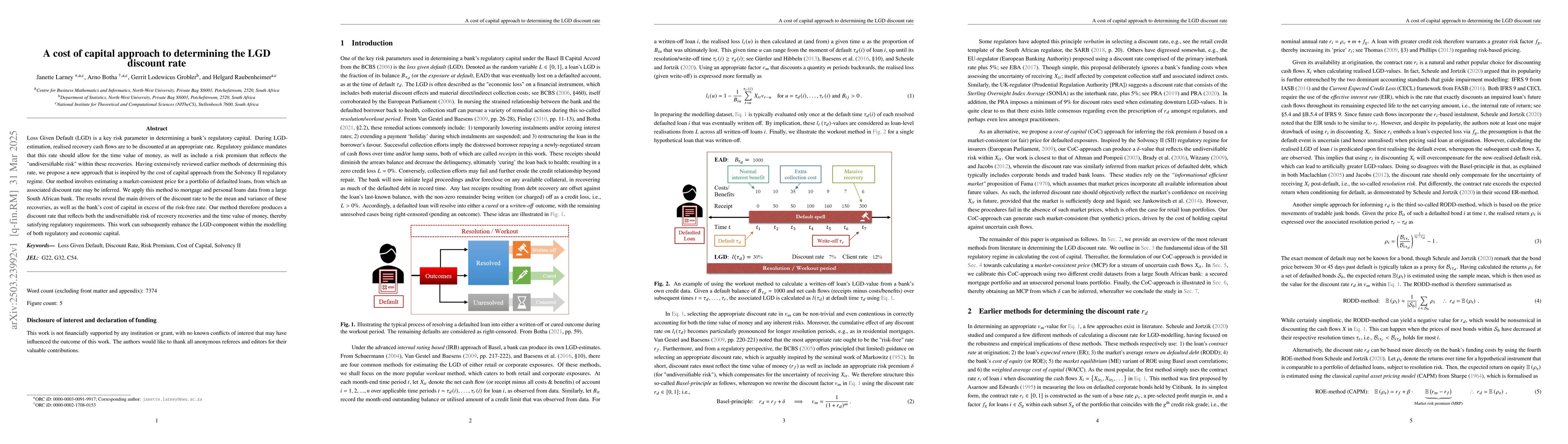

A cost of capital approach to determining the LGD discount rate

Loss Given Default (LGD) is a key risk parameter in determining a bank's regulatory capital. During LGD-estimation, realised recovery cash flows are to be discounted at an appropriate rate. Regulatory...

Approaches for modelling the term-structure of default risk under IFRS 9: A tutorial using discrete-time survival analysis

Under the International Financial Reporting Standards (IFRS) 9, credit losses ought to be recognised timeously and accurately. This requirement belies a certain degree of dynamicity when estimating th...