Summary

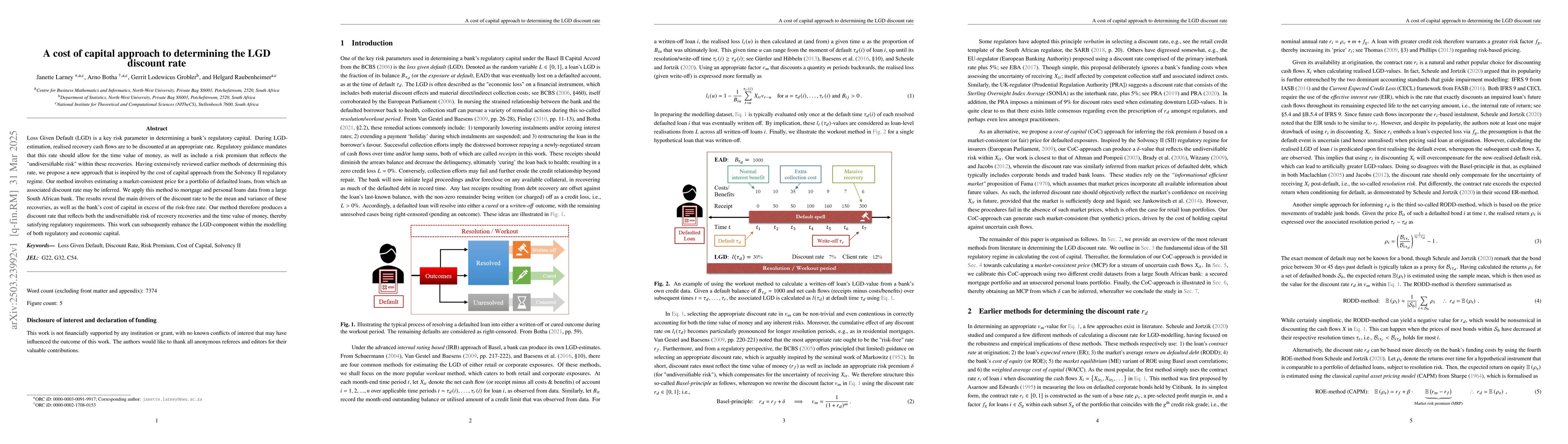

Loss Given Default (LGD) is a key risk parameter in determining a bank's regulatory capital. During LGD-estimation, realised recovery cash flows are to be discounted at an appropriate rate. Regulatory guidance mandates that this rate should allow for the time value of money, as well as include a risk premium that reflects the "undiversifiable risk" within these recoveries. Having extensively reviewed earlier methods of determining this rate, we propose a new approach that is inspired by the cost of capital approach from the Solvency II regulatory regime. Our method involves estimating a market-consistent price for a portfolio of defaulted loans, from which an associated discount rate may be inferred. We apply this method to mortgage and personal loans data from a large South African bank. The results reveal the main drivers of the discount rate to be the mean and variance of these recoveries, as well as the bank's cost of capital in excess of the risk-free rate. Our method therefore produces a discount rate that reflects both the undiversifiable risk of recovery recoveries and the time value of money, thereby satisfying regulatory requirements. This work can subsequently enhance the LGD-component within the modelling of both regulatory and economic capital.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research proposes a new approach to determine the LGD discount rate inspired by the cost of capital approach from Solvency II, estimating a market-consistent price for a portfolio of defaulted loans to infer an associated discount rate.

Key Results

- The discount rate is mainly driven by the mean and variance of recovery cash flows, as well as the bank's cost of capital in excess of the risk-free rate.

- The method produces a discount rate reflecting both the undiversifiable risk of recovery cash flows and the time value of money, satisfying regulatory requirements.

- The findings can enhance the LGD-component within the modelling of both regulatory and economic capital.

Significance

This research is important as it provides an improved method for determining the LGD discount rate, ensuring compliance with regulatory requirements while offering a more accurate reflection of risk and time value.

Technical Contribution

The main technical contribution is the development of a novel cost of capital approach to determine the LGD discount rate, incorporating both undiversifiable risk and time value of money.

Novelty

This work differs from existing research by proposing a market-consistent price estimation for defaulted loans, thereby inferring a discount rate that more accurately reflects both risk and time value requirements as per regulatory guidelines.

Limitations

- The study is based on data from a single large South African bank, which may limit its generalizability to other banking contexts.

- The approach assumes a market-consistent price for defaulted loans, which might not always be accurately estimable.

Future Work

- Further research could explore the applicability of this method across various banking sectors and geographical regions.

- Investigating alternative methods to estimate the market-consistent price for defaulted loans could enhance the robustness of the approach.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)