Summary

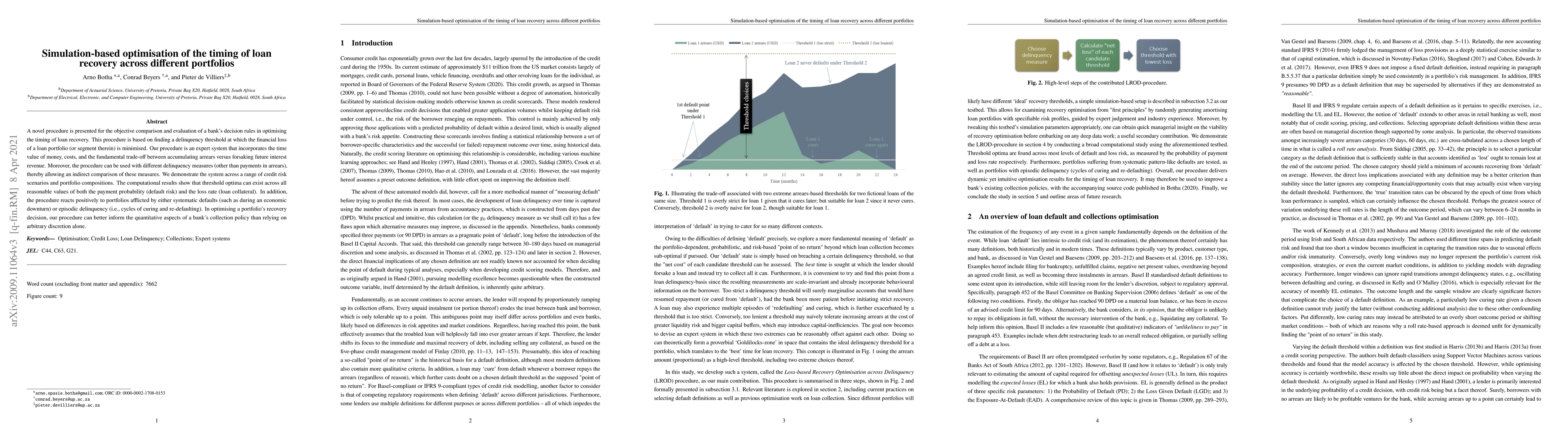

A novel procedure is presented for the objective comparison and evaluation of a bank's decision rules in optimising the timing of loan recovery. This procedure is based on finding a delinquency threshold at which the financial loss of a loan portfolio (or segment therein) is minimised. Our procedure is an expert system that incorporates the time value of money, costs, and the fundamental trade-off between accumulating arrears versus forsaking future interest revenue. Moreover, the procedure can be used with different delinquency measures (other than payments in arrears), thereby allowing an indirect comparison of these measures. We demonstrate the system across a range of credit risk scenarios and portfolio compositions. The computational results show that threshold optima can exist across all reasonable values of both the payment probability (default risk) and the loss rate (loan collateral). In addition, the procedure reacts positively to portfolios afflicted by either systematic defaults (such as during an economic downturn) or episodic delinquency (i.e., cycles of curing and re-defaulting). In optimising a portfolio's recovery decision, our procedure can better inform the quantitative aspects of a bank's collection policy than relying on arbitrary discretion alone.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe loss optimisation of loan recovery decision times using forecast cash flows

Arno Botha, Conrad Beyers, Pieter de Villiers

| Title | Authors | Year | Actions |

|---|

Comments (0)