Summary

We find that factors explaining bank loan recovery rates vary depending on the state of the economic cycle. Our modeling approach incorporates a two-state Markov switching mechanism as a proxy for the latent credit cycle, helping to explain differences in observed recovery rates over time. We are able to demonstrate how the probability of default and certain loan-specific and other variables hold different explanatory power with respect to recovery rates over `good' and `bad' times in the credit cycle. That is, the relationship between recovery rates and certain loan characteristics, firm characteristics and the probability of default differs depending on underlying credit market conditions. This holds important implications for modelling capital retention, particularly in terms of countercyclicality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

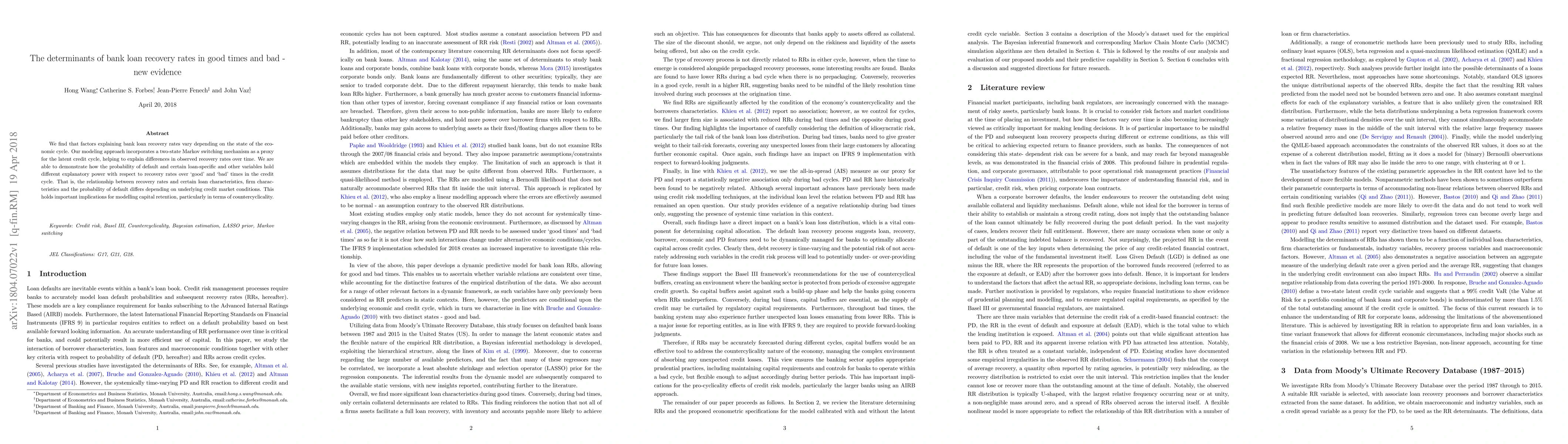

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe loss optimisation of loan recovery decision times using forecast cash flows

Arno Botha, Conrad Beyers, Pieter de Villiers

Effect on New Loan Repayment Fine Clause on Bank Jaya Artha's Customer Satisfaction and Recommendation

Yos Sunitiyoso, Mustaqim Adamrah

Dynamic Evidence Disclosure: Delay the Good to Accelerate the Bad

Jan Knoepfle, Julia Salmi

| Title | Authors | Year | Actions |

|---|

Comments (0)