Blanka Horvath

12 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Filtered not Mixed: Stochastic Filtering-Based Online Gating for Mixture of Large Language Models

We propose MoE-F -- a formalised mechanism for combining $N$ pre-trained expert Large Language Models (LLMs) in online time-series prediction tasks by adaptively forecasting the best weighting of LL...

Reality Only Happens Once: Single-Path Generalization Bounds for Transformers

One of the inherent challenges in deploying transformers on time series is that \emph{reality only happens once}; namely, one typically only has access to a single trajectory of the data-generating ...

Signature Trading: A Path-Dependent Extension of the Mean-Variance Framework with Exogenous Signals

In this article we introduce a portfolio optimisation framework, in which the use of rough path signatures (Lyons, 1998) provides a novel method of incorporating path-dependencies in the joint signa...

Robust Hedging GANs

The availability of deep hedging has opened new horizons for solving hedging problems under a large variety of realistic market conditions. At the same time, any model - be it a traditional stochast...

Non-parametric online market regime detection and regime clustering for multidimensional and path-dependent data structures

In this work we present a non-parametric online market regime detection method for multidimensional data structures using a path-wise two-sample test derived from a maximum mean discrepancy-based si...

Non-adversarial training of Neural SDEs with signature kernel scores

Neural SDEs are continuous-time generative models for sequential data. State-of-the-art performance for irregular time series generation has been previously obtained by training these models adversa...

Optimal Stopping via Distribution Regression: a Higher Rank Signature Approach

Distribution Regression on path-space refers to the task of learning functions mapping the law of a stochastic process to a scalar target. The learning procedure based on the notion of path-signatur...

Functional central limit theorems for rough volatility

The non-Markovian nature of rough volatility processes makes Monte Carlo methods challenging and it is in fact a major challenge to develop fast and accurate simulation algorithms. We provide an eff...

Scalable Signature-Based Distribution Regression via Reference Sets

Distribution Regression (DR) on stochastic processes describes the learning task of regression on collections of time series. Path signatures, a technique prevalent in stochastic analysis, have been u...

Signature Maximum Mean Discrepancy Two-Sample Statistical Tests

Maximum Mean Discrepancy (MMD) is a widely used concept in machine learning research which has gained popularity in recent years as a highly effective tool for comparing (finite-dimensional) distribut...

Uncertainty-Aware Strategies: A Model-Agnostic Framework for Robust Financial Optimization through Subsampling

This paper addresses the challenge of model uncertainty in quantitative finance, where decisions in portfolio allocation, derivative pricing, and risk management rely on estimating stochastic models f...

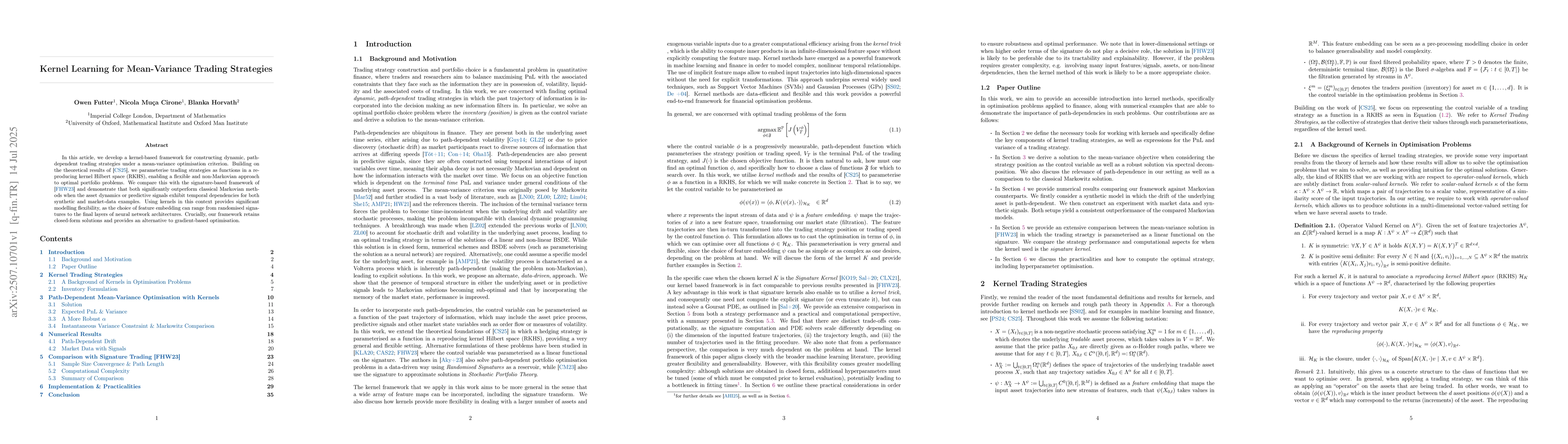

Kernel Learning for Mean-Variance Trading Strategies

In this article, we develop a kernel-based framework for constructing dynamic, pathdependent trading strategies under a mean-variance optimisation criterion. Building on the theoretical results of (Mu...