Summary

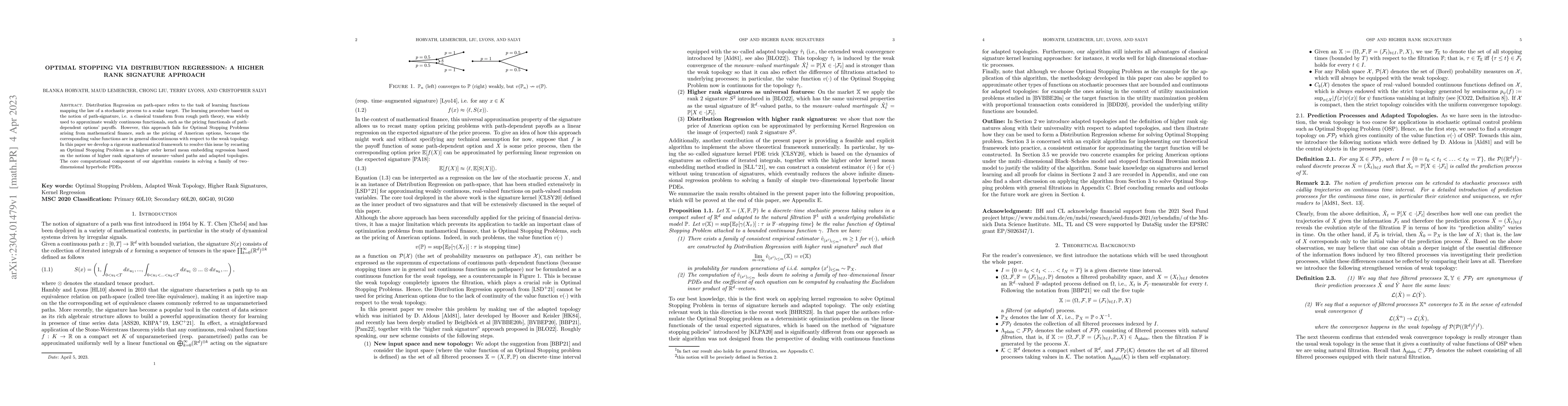

Distribution Regression on path-space refers to the task of learning functions mapping the law of a stochastic process to a scalar target. The learning procedure based on the notion of path-signature, i.e. a classical transform from rough path theory, was widely used to approximate weakly continuous functionals, such as the pricing functionals of path--dependent options' payoffs. However, this approach fails for Optimal Stopping Problems arising from mathematical finance, such as the pricing of American options, because the corresponding value functions are in general discontinuous with respect to the weak topology. In this paper we develop a rigorous mathematical framework to resolve this issue by recasting an Optimal Stopping Problem as a higher order kernel mean embedding regression based on the notions of higher rank signatures of measure--valued paths and adapted topologies. The core computational component of our algorithm consists in solving a family of two--dimensional hyperbolic PDEs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)