Authors

Summary

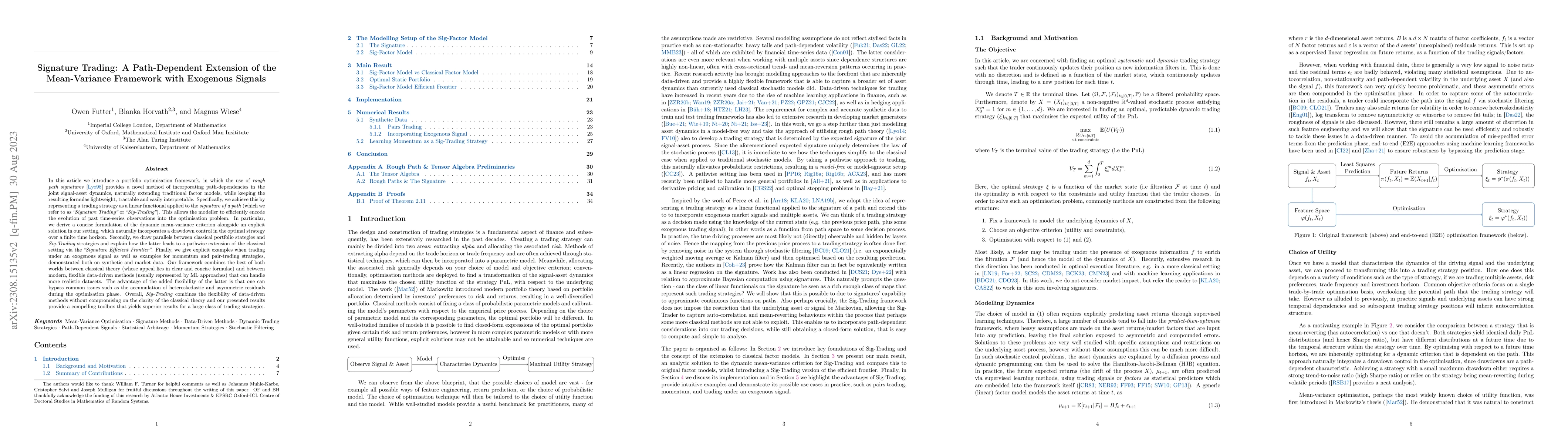

In this article we introduce a portfolio optimisation framework, in which the use of rough path signatures (Lyons, 1998) provides a novel method of incorporating path-dependencies in the joint signal-asset dynamics, naturally extending traditional factor models, while keeping the resulting formulas lightweight and easily interpretable. We achieve this by representing a trading strategy as a linear functional applied to the signature of a path (which we refer to as "Signature Trading" or "Sig-Trading"). This allows the modeller to efficiently encode the evolution of past time-series observations into the optimisation problem. In particular, we derive a concise formulation of the dynamic mean-variance criterion alongside an explicit solution in our setting, which naturally incorporates a drawdown control in the optimal strategy over a finite time horizon. Secondly, we draw parallels between classical portfolio stategies and Sig-Trading strategies and explain how the latter leads to a pathwise extension of the classical setting via the "Signature Efficient Frontier". Finally, we give examples when trading under an exogenous signal as well as examples for momentum and pair-trading strategies, demonstrated both on synthetic and market data. Our framework combines the best of both worlds between classical theory (whose appeal lies in clear and concise formulae) and between modern, flexible data-driven methods that can handle more realistic datasets. The advantage of the added flexibility of the latter is that one can bypass common issues such as the accumulation of heteroskedastic and asymmetric residuals during the optimisation phase. Overall, Sig-Trading combines the flexibility of data-driven methods without compromising on the clarity of the classical theory and our presented results provide a compelling toolbox that yields superior results for a large class of trading strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKernel Learning for Mean-Variance Trading Strategies

Nicola Muca Cirone, Blanka Horvath, Owen Futter

Deep Signature Algorithm for Multi-dimensional Path-Dependent Options

Erhan Bayraktar, Qi Feng, Zhaoyu Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)