David Itkin

6 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Calibrated rank volatility stabilized models for large equity markets

In the framework of stochastic portfolio theory we introduce rank volatility stabilized models for large equity markets over long time horizons. These models are rank-based extensions of the volatil...

Generalized Rank Dirichlet Distributions

We study a new parametric family of distributions on the ordered simplex $\nabla^{d-1} = \{y \in \mathbb{R}^d: y_1 \geq \dots \geq y_d \geq 0, \sum_{k=1}^d y_k = 1\}$, which we call Generalized Rank...

Ergodic robust maximization of asymptotic growth under stochastic volatility

We consider an asymptotic robust growth problem under model uncertainty and in the presence of (non-Markovian) stochastic covariance. We fix two inputs representing the instantaneous covariance for ...

Open Markets and Hybrid Jacobi Processes

We propose a unified approach to several problems in Stochastic Portfolio Theory (SPT), which is a framework for equity markets with a large number $d$ of stocks. Our approach combines open markets,...

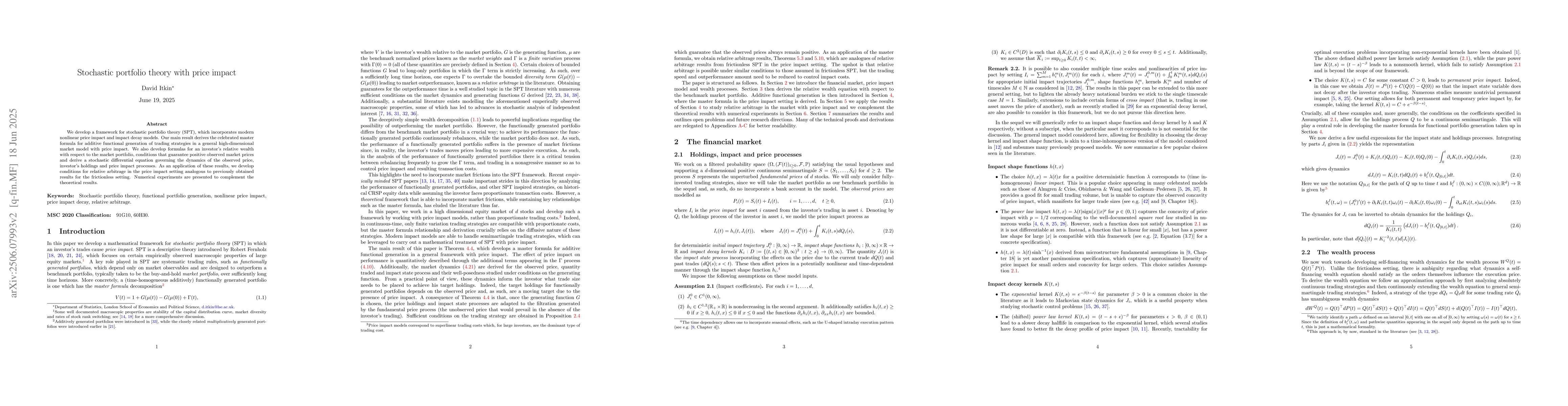

Stochastic portfolio theory with price impact

We develop a framework for stochastic portfolio theory (SPT), which incorporates modern nonlinear price impact and impact decay models. Our main result derives the celebrated master formula for (addit...

Consumption-Investment Problem in Rank-Based Models

We study a consumption-investment problem in a multi-asset market where the returns follow a generic rank-based model. Our main result derives an HJB equation with Neumann boundary conditions for the ...