Authors

Summary

We develop a framework for stochastic portfolio theory (SPT), which incorporates modern nonlinear price impact and impact decay models. Our main result derives the celebrated master formula for (additive) functional generation of trading strategies in a general high-dimensional market model with price impact. We also develop formulas for an investor's relative wealth with respect to the market portfolio, conditions that guarantee positive observed market prices and derive a stochastic differential equation governing the dynamics of the observed price, investor's holdings and price impact processes. As an application of these results, we develop conditions for relative arbitrage in the price impact setting analogous to previously obtained results for the frictionless setting. Numerical experiments are presented to complement the theoretical results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

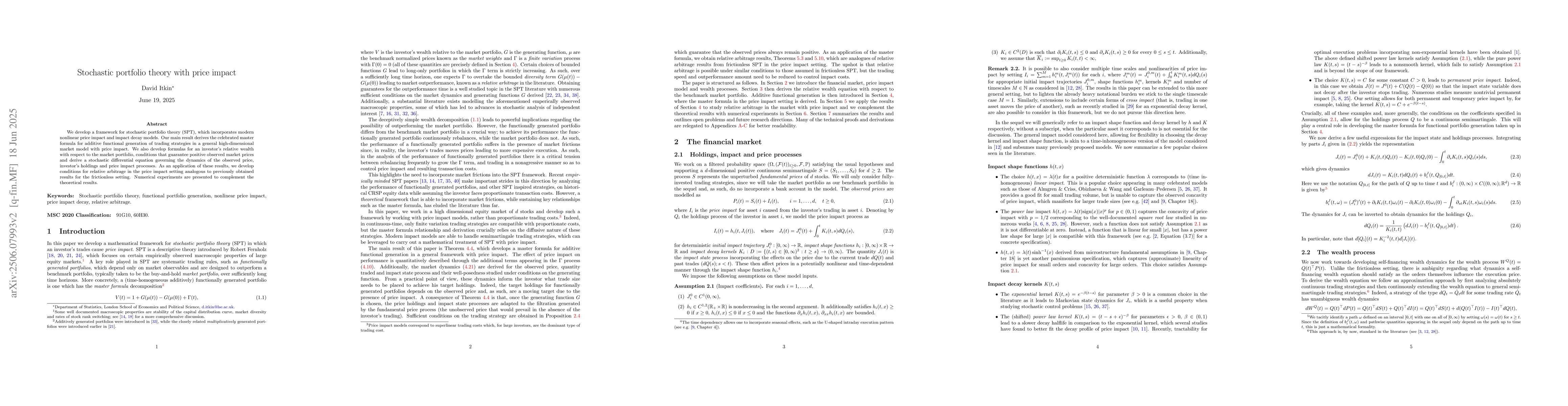

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)