Hans Buehler

6 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

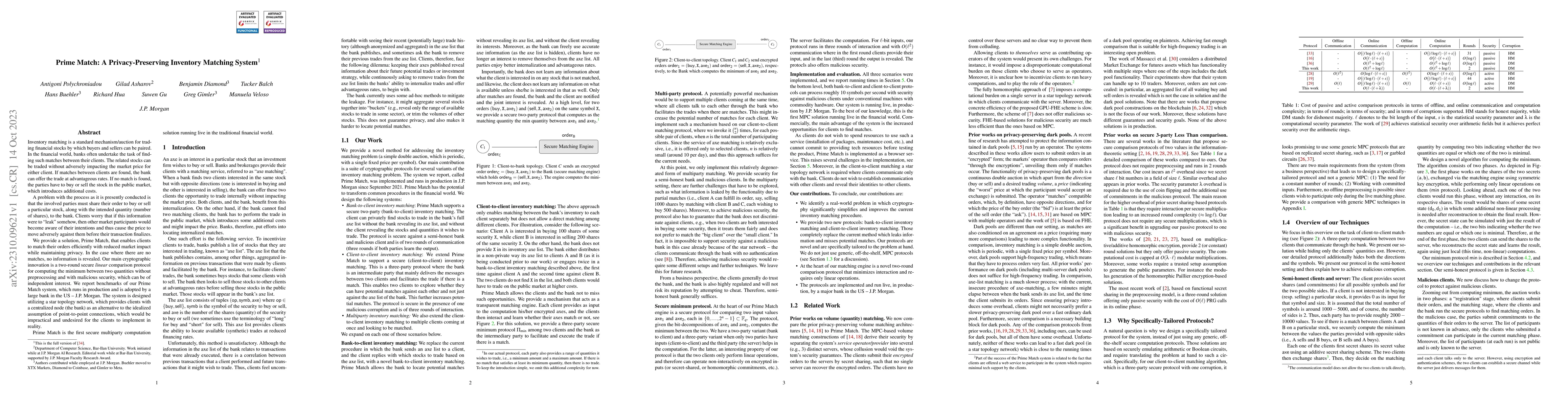

Prime Match: A Privacy-Preserving Inventory Matching System

Inventory matching is a standard mechanism/auction for trading financial stocks by which buyers and sellers can be paired. In the financial world, banks often undertake the task of finding such matc...

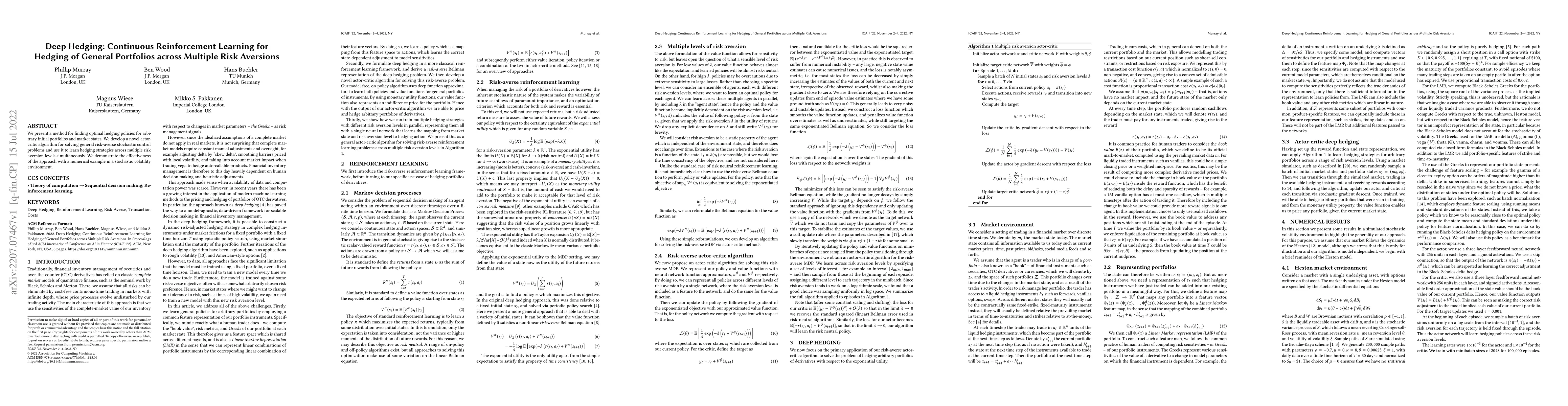

Deep Hedging: Continuous Reinforcement Learning for Hedging of General Portfolios across Multiple Risk Aversions

We present a method for finding optimal hedging policies for arbitrary initial portfolios and market states. We develop a novel actor-critic algorithm for solving general risk-averse stochastic cont...

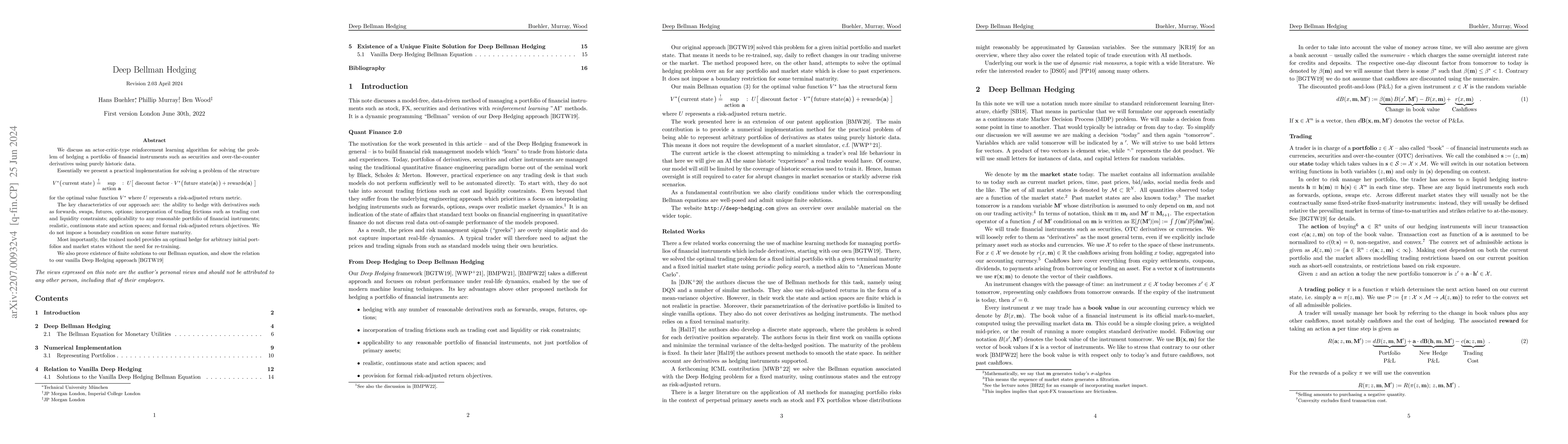

Deep Bellman Hedging

We present an actor-critic-type reinforcement learning algorithm for solving the problem of hedging a portfolio of financial instruments such as securities and over-the-counter derivatives using pur...

Multi-Asset Spot and Option Market Simulation

We construct realistic spot and equity option market simulators for a single underlying on the basis of normalizing flows. We address the high-dimensionality of market observed call prices through a...

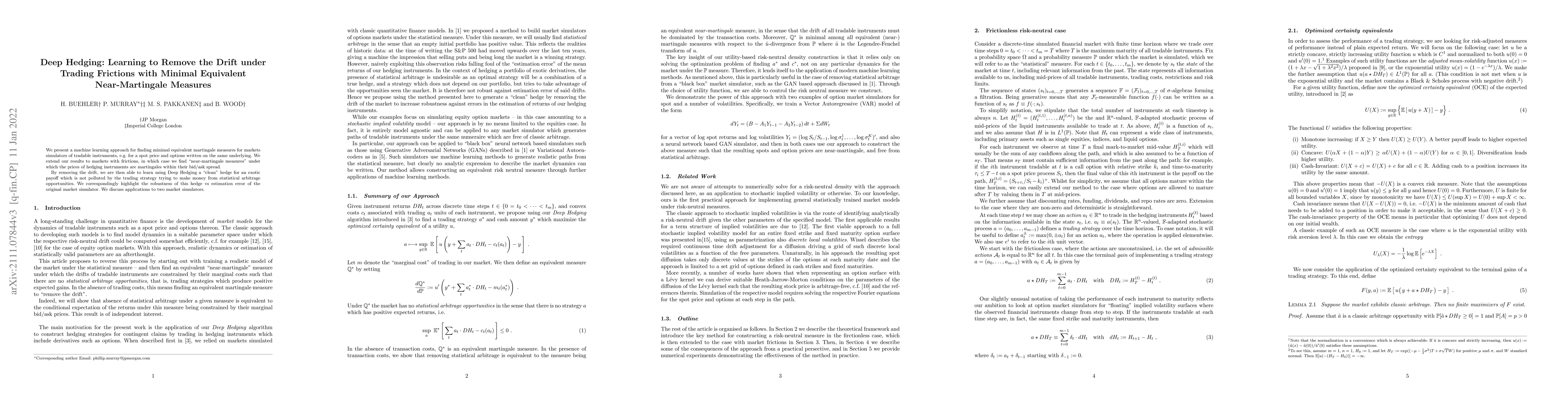

Deep Hedging: Learning to Remove the Drift under Trading Frictions with Minimal Equivalent Near-Martingale Measures

We present a machine learning approach for finding minimal equivalent martingale measures for markets simulators of tradable instruments, e.g. for a spot price and options written on the same underl...

Uncertainty-Aware Strategies: A Model-Agnostic Framework for Robust Financial Optimization through Subsampling

This paper addresses the challenge of model uncertainty in quantitative finance, where decisions in portfolio allocation, derivative pricing, and risk management rely on estimating stochastic models f...