Authors

Summary

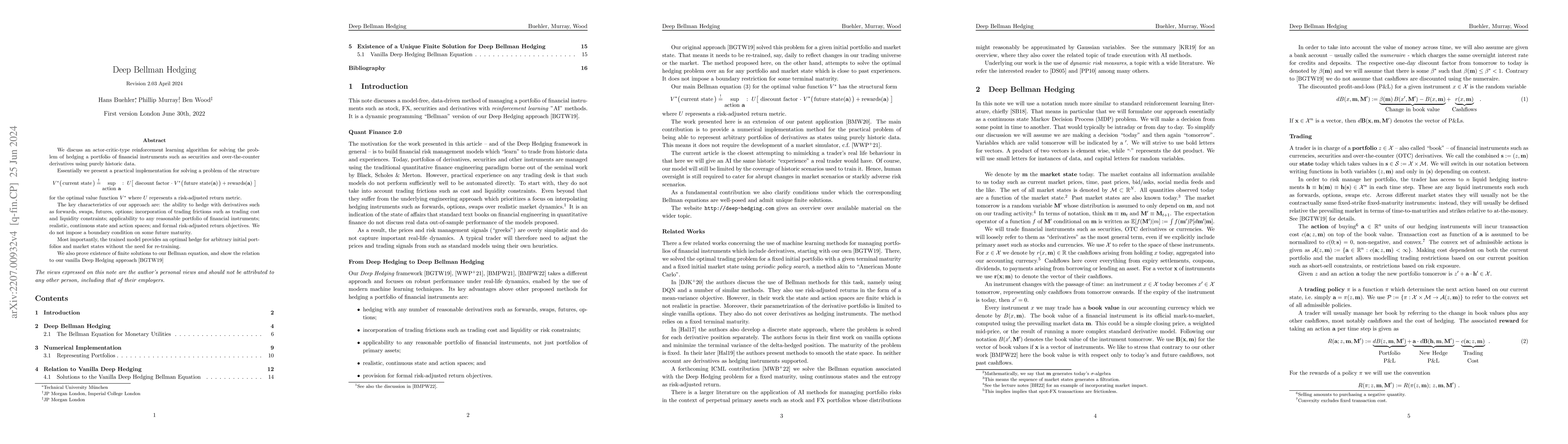

We present an actor-critic-type reinforcement learning algorithm for solving the problem of hedging a portfolio of financial instruments such as securities and over-the-counter derivatives using purely historic data. The key characteristics of our approach are: the ability to hedge with derivatives such as forwards, swaps, futures, options; incorporation of trading frictions such as trading cost and liquidity constraints; applicability for any reasonable portfolio of financial instruments; realistic, continuous state and action spaces; and formal risk-adjusted return objectives. Most importantly, the trained model provides an optimal hedge for arbitrary initial portfolios and market states without the need for re-training. We also prove existence of finite solutions to our Bellman equation, and show the relation to our vanilla Deep Hedging approach

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)