Xia Han

18 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Robust Lambda-quantiles and extreme probabilities

In this paper, we investigate the robust models for $\Lambda$-quantiles with partial information regarding the loss distribution, where $\Lambda$-quantiles extend the classical quantiles by replacin...

Optimal insurance with mean-deviation measures

This paper studies an optimal insurance contracting problem in which the preferences of the decision maker given by the sum of the expected loss and a convex, increasing function of a deviation meas...

Monotonic mean-deviation risk measures

Mean-deviation models, along with the existing theory of coherent risk measures, are well studied in the literature. In this paper, we characterize monotonic mean-deviation (risk) measures from a ge...

Exploratory mean-variance portfolio selection with Choquet regularizers

In this paper, we study a continuous-time exploratory mean-variance (EMV) problem under the framework of reinforcement learning (RL), and the Choquet regularizers are used to measure the level of ex...

Multilinear $\theta$-type Calderon--Zygmund operators and their commutators on products of weighted amalgam spaces

In this paper, we first introduce several new classes of weighted amalgam spaces. Then we discuss both strong type and weak type estimates for certain multilinear $\theta$-type Calder\'on--Zygmund o...

Multilinear $\theta$-type Calder\'on--Zygmund operators and commutators on products of weighted Morrey spaces

In this paper, we consider the boundedness properties of multilinear $\theta$-type Calder\'on--Zygmund operators $T_\theta$ recently introduced in the literature. First, we prove strong type and wea...

Diversification quotients based on VaR and ES

The diversification quotient (DQ) is recently introduced for quantifying the degree of diversification of a stochastic portfolio model. It has an axiomatic foundation and can be defined through a pa...

Choquet regularization for reinforcement learning

We propose \emph{Choquet regularizers} to measure and manage the level of exploration for reinforcement learning (RL), and reformulate the continuous-time entropy-regularized RL problem of Wang et a...

Diversification quotients: Quantifying diversification via risk measures

We establish the first axiomatic theory for diversification indices using six intuitive axioms: non-negativity, location invariance, scale invariance, rationality, normalization, and continuity. The...

Cash-subadditive risk measures without quasi-convexity

In the literature of risk measures, cash subadditivity was proposed to replace cash additivity, motivated by the presence of stochastic or ambiguous interest rates and defaultable contingent claims....

Risk Concentration and the Mean-Expected Shortfall Criterion

Expected Shortfall (ES, also known as CVaR) is the most important coherent risk measure in finance, insurance, risk management, and engineering. Recently, Wang and Zitikis (2021) put forward four ec...

Diversification quotient based on expectiles

A diversification quotient (DQ) quantifies diversification in stochastic portfolio models based on a family of risk measures. We study DQ based on expectiles, offering a useful alternative to conventi...

Optimal insurance design with Lambda-Value-at-Risk

This paper explores optimal insurance solutions based on the Lambda-Value-at-Risk ($\Lambda\VaR$). If the expected value premium principle is used, our findings confirm that, similar to the VaR model,...

Dynamic reinsurance design with heterogeneous beliefs under the mean-variance framework

This paper investigates the dynamic reinsurance design problem under the mean-variance criterion, incorporating heterogeneous beliefs between the insurer and the reinsurer, and introducing an incentiv...

A non-zero-sum game with reinforcement learning under mean-variance framework

In this paper, we investigate a competitive market involving two agents who consider both their own wealth and the wealth gap with their opponent. Both agents can invest in a financial market consisti...

Empirical estimator of diversification quotient

The Diversification Quotient (DQ), introduced by Han et al. (2025), is a recently proposed measure of portfolio diversification that quantifies the reduction in a portfolio's risk-level parameter attr...

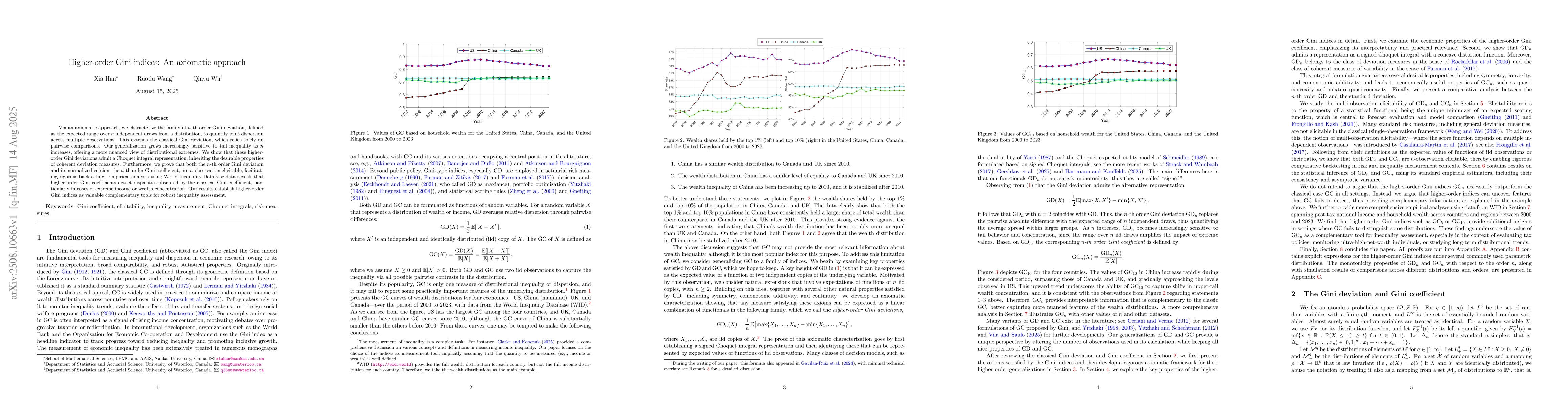

Higher-order Gini indices: An axiomatic approach

Via an axiomatic approach, we characterize the family of n-th order Gini deviation, defined as the expected range over n independent draws from a distribution, to quantify joint dispersion across mult...

Robustness Assessment and Enhancement of Text Watermarking for Google's SynthID

Recent advances in LLM watermarking methods such as SynthID-Text by Google DeepMind offer promising solutions for tracing the provenance of AI-generated text. However, our robustness assessment reveal...