Authors

Summary

The Diversification Quotient (DQ), introduced by Han et al. (2025), is a recently proposed measure of portfolio diversification that quantifies the reduction in a portfolio's risk-level parameter attributable to diversification. Grounded in a rigorous theoretical framework, DQ effectively captures heavy tails, common shocks, and enhances efficiency in portfolio optimization. This paper further explores the convergence properties and asymptotic normality of empirical DQ estimators based on Value at Risk (VaR) and Expected Shortfall (ES), with explicit calculation of the asymptotic variance. In contrast to the diversification ratio (DR) proposed by Tasche (2007), which may exhibit diverging asymptotic variance due to its lack of location invariance, the DQ estimators demonstrate greater robustness under various distributional settings. We further evaluate their performance under elliptical distributions and conduct a simulation study to examine their finite-sample behavior. The results offer a solid statistical foundation for the application of DQ in financial risk management and decision-making.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

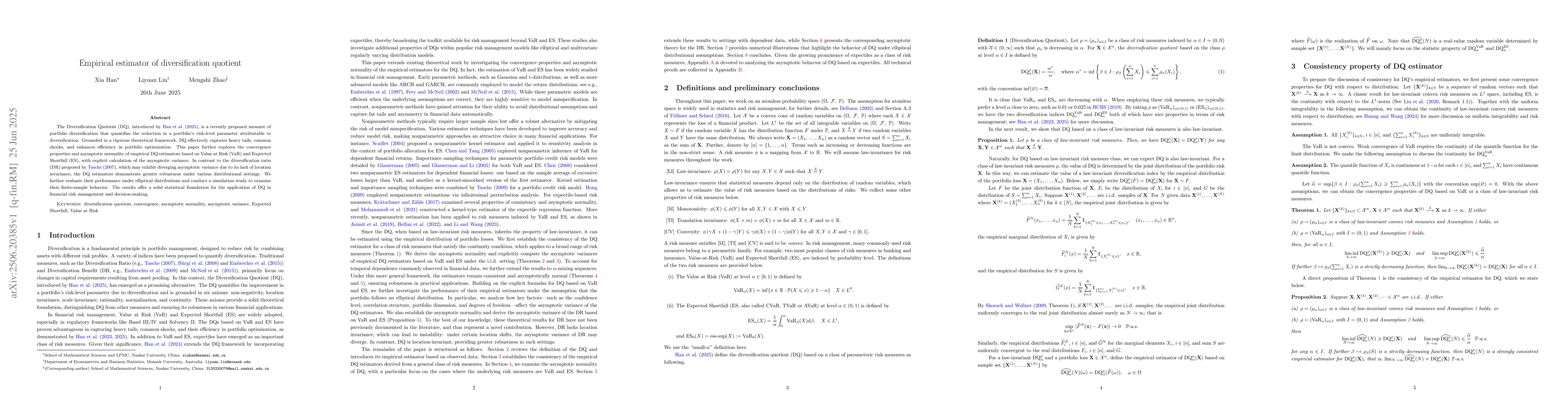

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDiversification quotient based on expectiles

Hao Wang, Xia Han, Liyuan Lin et al.

A Distributionally Robust Estimator that Dominates the Empirical Average

Nikolas Koumpis, Dionysis Kalogerias

Empirical sandwich variance estimator for iterated conditional expectation g-computation

Paul N Zivich, Jessie K Edwards, Bonnie E Shook-Sa et al.

No citations found for this paper.

Comments (0)