Xue Cheng

8 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Mean Field Game of High-Frequency Anticipatory Trading

The interactions between a large population of high-frequency traders (HFTs) and a large trader (LT) who executes a certain amount of assets at discrete time points are studied. HFTs are faster in t...

Trading Large Orders in the Presence of Multiple High-Frequency Anticipatory Traders

We investigate a market with a normal-speed informed trader (IT) who may employ mixed strategy and multiple anticipatory high-frequency traders (HFTs) who are under different inventory pressures, in...

Approximating Smiles: A Time Change Approach

We present a new method for approximating the shape of implied volatility smiles. The method is applicable to common semimartingale models, such as jump-diffusion, rough volatility, and infinite act...

Optimal Order Execution subject to Reservation Strategies under Execution Risk

The paper addresses the problem of meta order execution from a broker-dealer's point of view in Almgren-Chriss model under order fill uncertainty. A broker-dealer agency is authorized to execute an ...

The Effects of High-frequency Anticipatory Trading: Small Informed Trader vs. Round-Tripper

In an extended Kyle's model, the interactions between a large informed trader and a high-frequency trader (HFT) who can anticipate the former's incoming order are studied. We find that, in equilibri...

Are Large Traders Harmed by Front-running HFTs?

This paper studies the influences of a high-frequency trader (HFT) on a large trader whose future trading is predicted by the former. We conclude that HFT always front-runs and the large trader is b...

Fast Learning in Quantitative Finance with Extreme Learning Machine

A critical factor in adopting machine learning for time-sensitive financial tasks is computational speed, including model training and inference. This paper demonstrates that a broad class of such pro...

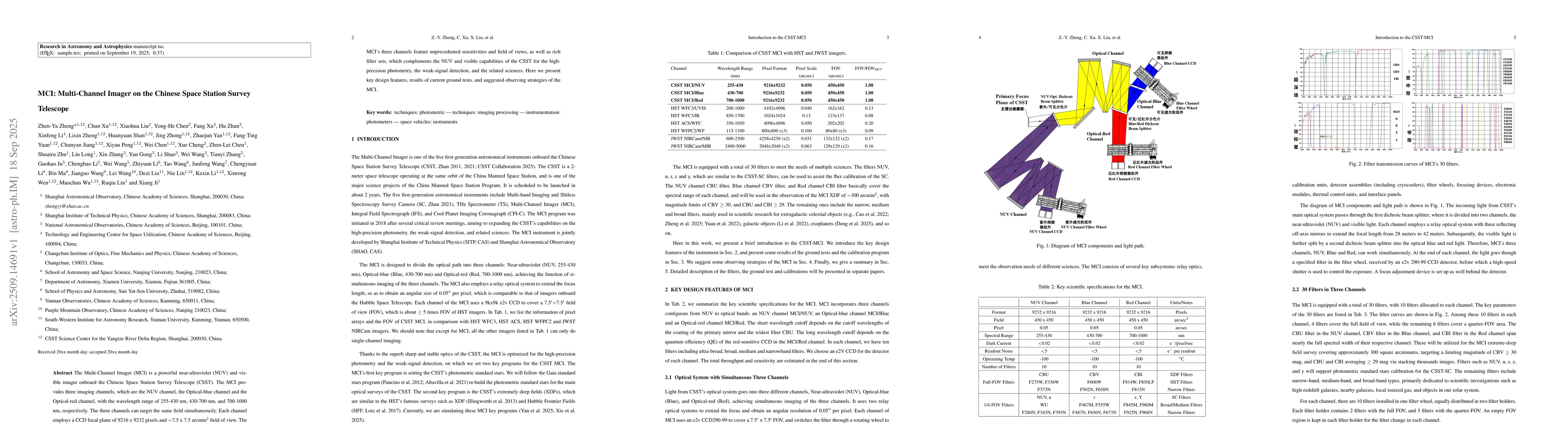

MCI: Multi-Channel Imager on the Chinese Space Station Survey Telescope

The Multi-Channel Imager (MCI) is a powerful near-ultraviolet (NUV) and visible imager onboard the Chinese Space Station Survey Telescope (CSST). The MCI provides three imaging channels, which are the...