Summary

We investigate a market with a normal-speed informed trader (IT) who may employ mixed strategy and multiple anticipatory high-frequency traders (HFTs) who are under different inventory pressures, in a three-period Kyle's model. The pure- and mixed-strategy equilibria are considered and the results provide recommendations for IT's randomization strategy with different numbers of HFTs. Some surprising results about investors' profits arise: the improvement of anticipatory traders' speed or a more precise prediction may harm themselves but help IT.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

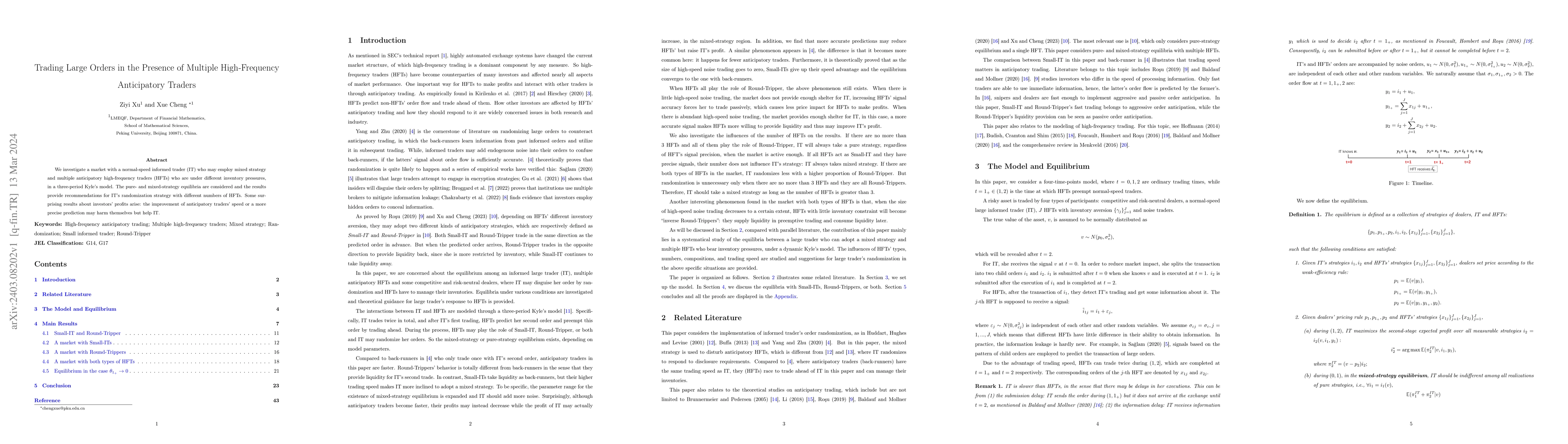

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMean Field Game of High-Frequency Anticipatory Trading

Meng Wang, Ziyi Xu, Xue Cheng

No citations found for this paper.

Comments (0)