Summary

The interactions between a large population of high-frequency traders (HFTs) and a large trader (LT) who executes a certain amount of assets at discrete time points are studied. HFTs are faster in the sense that they trade continuously and predict the transactions of LT. A jump process is applied to model the transition of HFTs' attitudes towards inventories and the equilibrium is solved through the mean field game approach. When the crowd of HFTs is averse to running (ending) inventories, they first take then supply liquidity at each transaction of LT (throughout the whole execution period). Inventory-averse HFTs lower LT's costs if the market temporary impact is relatively large to the permanent one. What's more, the repeated liquidity consuming-supplying behavior of HFTs makes LT's optimal strategy close to uniform trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

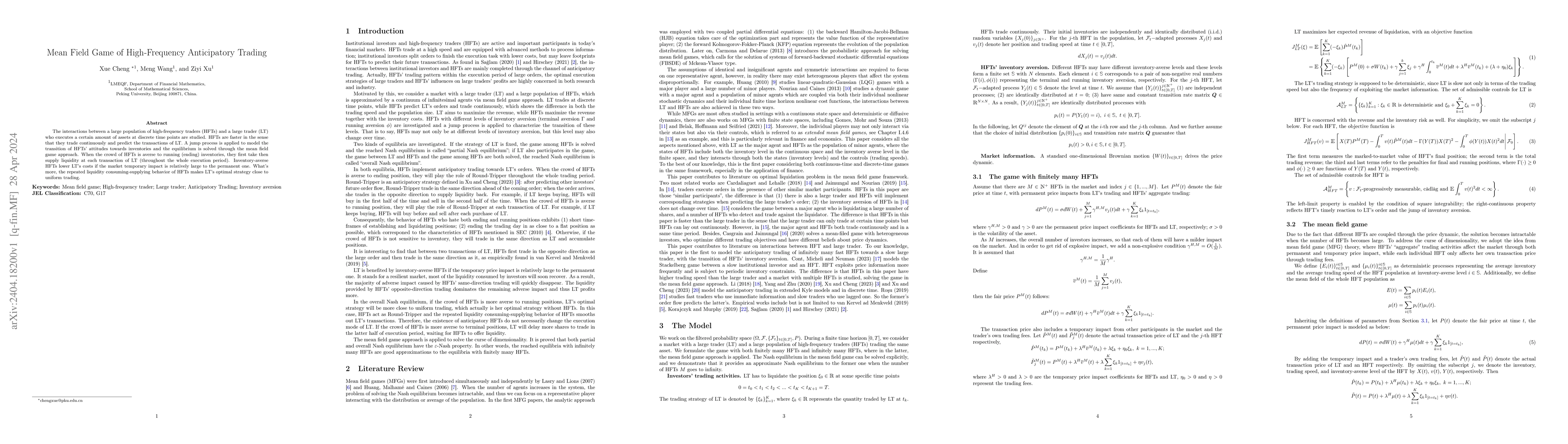

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrading Large Orders in the Presence of Multiple High-Frequency Anticipatory Traders

Ziyi Xu, Xue Cheng

The Effects of High-frequency Anticipatory Trading: Small Informed Trader vs. Round-Tripper

Ziyi Xu, Xue Cheng

A Mean-Field Game of Market Entry: Portfolio Liquidation with Trading Constraints

Guanxing Fu, Paul P. Hager, Ulrich Horst

No citations found for this paper.

Comments (0)