Summary

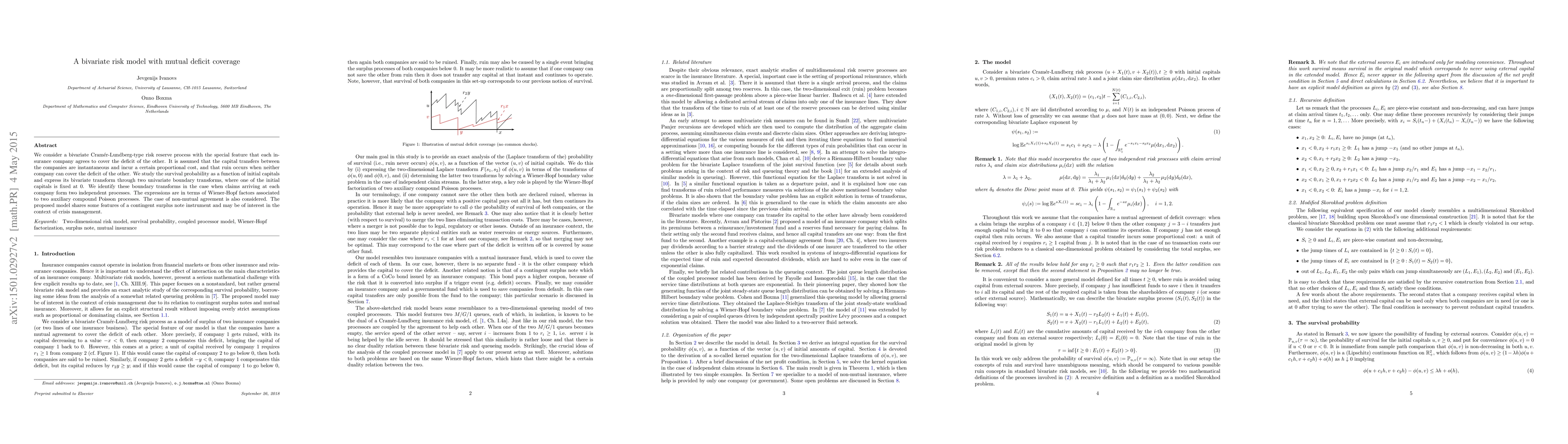

We consider a bivariate Cramer-Lundberg-type risk reserve process with the special feature that each insurance company agrees to cover the deficit of the other. It is assumed that the capital transfers between the companies are instantaneous and incur a certain proportional cost, and that ruin occurs when neither company can cover the deficit of the other. We study the survival probability as a function of initial capitals and express its bivariate transform through two univariate boundary transforms, where one of the initial capitals is fixed at 0. We identify these boundary transforms in the case when claims arriving at each company form two independent processes. The expressions are in terms of Wiener-Hopf factors associated to two auxiliary compound Poisson processes. The case of non-mutual (reinsurance) agreement is also considered.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBivariate Compound Poisson Risk Processes with Shocks

Evelina Veleva, Pavlina Jordanova, Kosto Mitov

Predicting Liquidity Coverage Ratio with Gated Recurrent Units: A Deep Learning Model for Risk Management

Zhen Xu, Yuan Chen, Jingming Pan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)