Authors

Summary

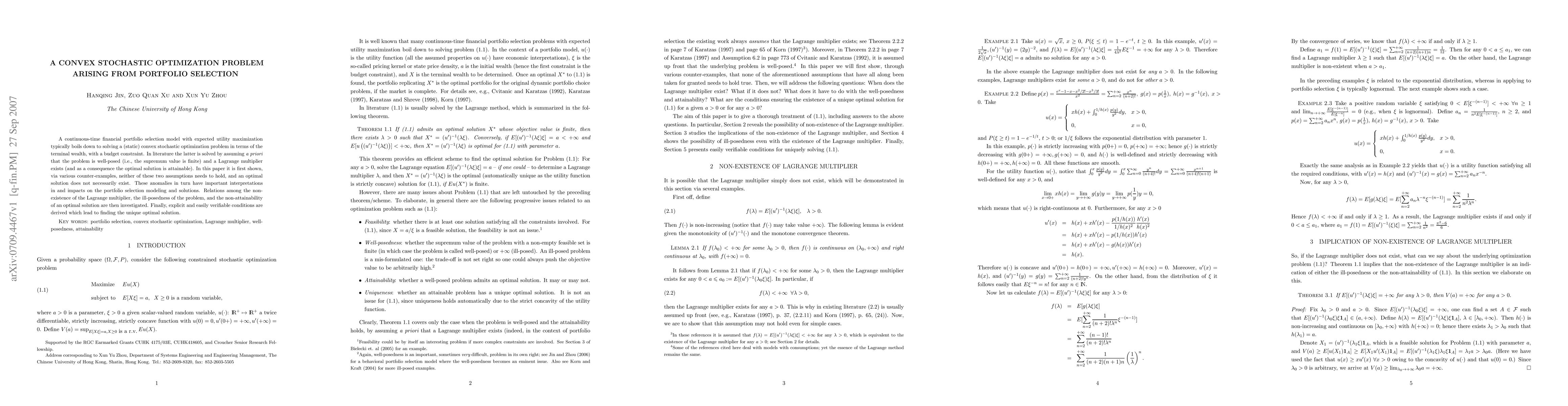

A continuous-time financial portfolio selection model with expected utility maximization typically boils down to solving a (static) convex stochastic optimization problem in terms of the terminal wealth, with a budget constraint. In literature the latter is solved by assuming {\it a priori} that the problem is well-posed (i.e., the supremum value is finite) and a Lagrange multiplier exists (and as a consequence the optimal solution is attainable). In this paper it is first shown, via various counter-examples, neither of these two assumptions needs to hold, and an optimal solution does not necessarily exist. These anomalies in turn have important interpretations in and impacts on the portfolio selection modeling and solutions. Relations among the non-existence of the Lagrange multiplier, the ill-posedness of the problem, and the non-attainability of an optimal solution are then investigated. Finally, explicit and easily verifiable conditions are derived which lead to finding the unique optimal solution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHamilton-Jacobi-Bellman Equation Arising from Optimal Portfolio Selection Problem

Daniel Sevcovic, Cyril Izuchukwu Udeani

An Integral Equation Arising from Time-Consistent Portfolio Selection

Sheng Wang, Jianming Xia, Zongxia Liang

| Title | Authors | Year | Actions |

|---|

Comments (0)