Authors

Summary

The classical Markowitz mean-variance model uses variance as a risk measure and calculates frontier portfolios in closed form by using standard optimization techniques. For general mean-risk models such closed form optimal portfolios are difficult to obtain. In this note, we obtain closed form expression for frontier portfolios under mean-risk criteria when risk is modelled by any finite law-invariant convex measures of risk and when return vectors follow the class of normal mean-variance mixture (NMVM) distributions. To achieve this goal, we first present necessary as well as sufficient conditions for stochastic dominance within the class of one dimensional NMVM models and then we apply them to portfolio optimization problems. Our main result in this paper states that when return vectors follow the class of NMVM distributions the associated mean-risk frontier portfolios can be obtained by optimizing a Markowitz mean-variance model with an appropriately adjusted return vector.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

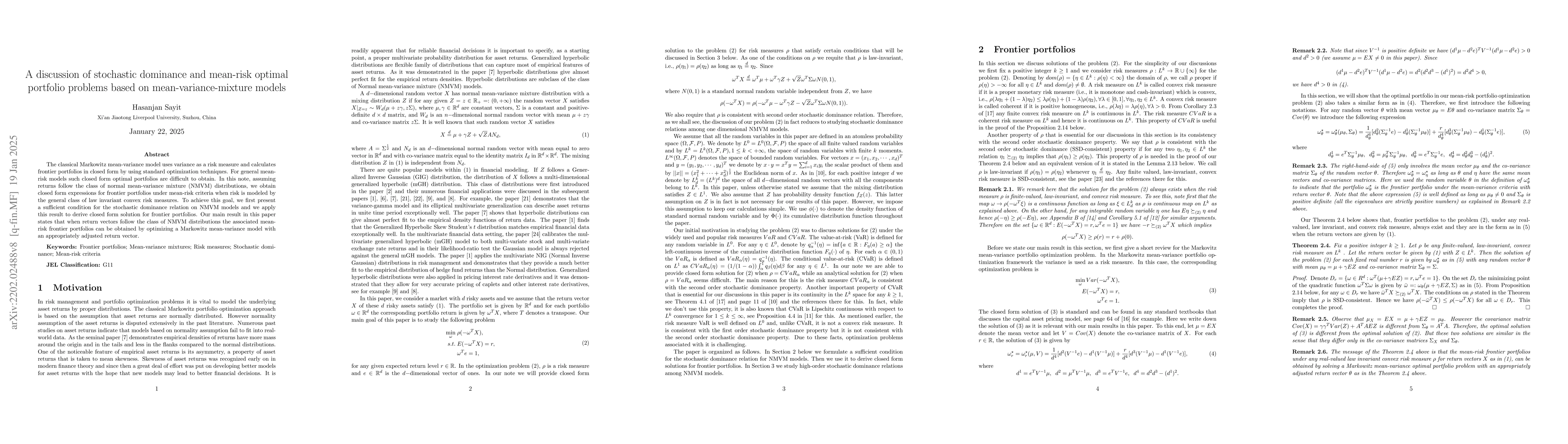

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolio analysis with mean-CVaR and mean-CVaR-skewness criteria based on mean-variance mixture models

Ruoyu Sun, Kai He, Svetlozar T. Rachev et al.

Mean-variance hybrid portfolio optimization with quantile-based risk measure

Jianjun Gao, Ke Zhou, Yu Lin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)