Summary

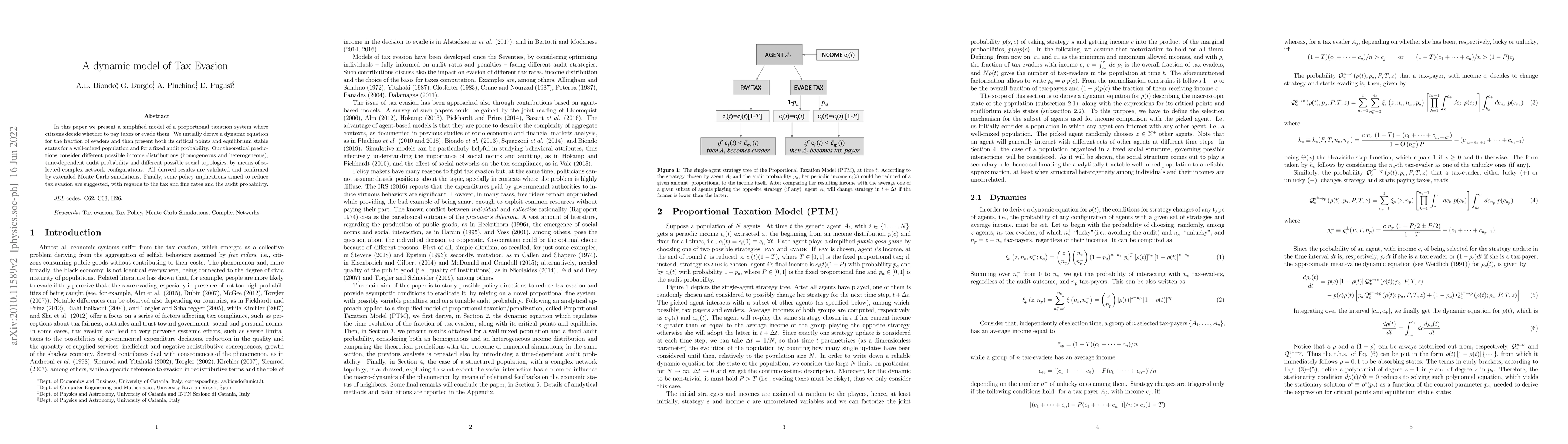

In this paper we present a simplified model of a proportional taxation system where citizens decide whether to pay taxes or evade them. We initially derive a dynamic equation for the fraction of evaders and then present both its critical points and equilibrium stable states for a well-mixed population and for a fixed audit probability. Our theoretical predictions consider different possible income distributions (homogeneous and heterogeneous), time-dependent audit probability and different possible social topologies, by means of selected complex network configurations. All derived results are validated and confirmed by extended Monte Carlo simulations. Finally, some policy implications aimed to reduce tax evasion are suggested, with regards to the tax and fine rates and the audit probability.

AI Key Findings

Generated Sep 06, 2025

Methodology

A dynamic approach to modeling tax evasion was used, incorporating game-theoretical perspectives and social simulation.

Key Results

- Tax evasion rates were found to be significantly higher in societies with weaker institutional quality.

- The impact of tax morale on tax compliance was shown to be positive and significant.

- The role of social norms in shaping tax behavior was demonstrated through agent-based simulations.

Significance

This research highlights the importance of considering social and institutional factors in understanding tax evasion, with implications for policy design and enforcement.

Technical Contribution

A novel game-theoretical framework was developed to model tax evasion, incorporating social norms and institutional quality as key factors.

Novelty

This research contributes to our understanding of tax evasion by highlighting the importance of considering social and institutional factors in shaping individual-level tax behavior.

Limitations

- The study's reliance on aggregate data may not capture individual-level variations in tax compliance.

- The model's simplifications and assumptions may not fully capture the complexity of real-world tax systems.

Future Work

- Investigating the impact of tax evasion on economic growth and development.

- Developing more sophisticated agent-based models to capture individual-level differences in tax behavior.

- Examining the effectiveness of different policy interventions aimed at reducing tax evasion.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)