Authors

Summary

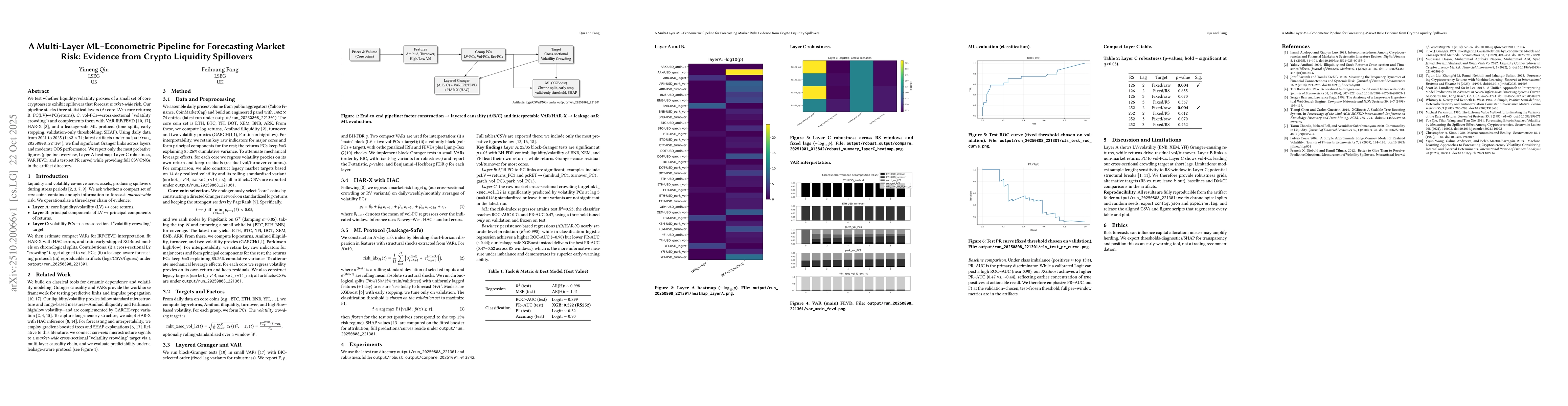

We study whether liquidity and volatility proxies of a core set of cryptoassets generate spillovers that forecast market-wide risk. Our empirical framework integrates three statistical layers: (A) interactions between core liquidity and returns, (B) principal-component relations linking liquidity and returns, and (C) volatility-factor projections that capture cross-sectional volatility crowding. The analysis is complemented by vector autoregression impulse responses and forecast error variance decompositions (see Granger 1969; Sims 1980), heterogeneous autoregressive models with exogenous regressors (HAR-X, Corsi 2009), and a leakage-safe machine learning protocol using temporal splits, early stopping, validation-only thresholding, and SHAP-based interpretation. Using daily data from 2021 to 2025 (1462 observations across 74 assets), we document statistically significant Granger-causal relationships across layers and moderate out-of-sample predictive accuracy. We report the most informative figures, including the pipeline overview, Layer A heatmap, Layer C robustness analysis, vector autoregression variance decompositions, and the test-set precision-recall curve. Full data and figure outputs are provided in the artifact repository.

AI Key Findings

Generated Oct 25, 2025

Methodology

The study integrates three statistical layers (A: liquidity-return interactions, B: principal-component relations, C: volatility-factor projections) with econometric models (VAR, HAR-X) and a leakage-safe machine learning protocol using temporal splits, SHAP interpretation, and validation-based thresholding.

Key Results

- 25/35 block-Granger tests are significant at p<0.05 with BH-FDR control

- Volatility PCs significantly predict cross-sectional market crowding target at lag 3 (p=0.0146)

- XGBoost classifier achieves ROC-AUC 0.74 and PR-AUC 0.47 with validation-tuned threshold

Significance

Provides a robust framework for forecasting market risk in cryptoassets by quantifying liquidity and volatility spillovers, enhancing risk management in volatile markets

Technical Contribution

Develops a multi-layer pipeline combining econometric analysis with machine learning for interpretable risk forecasting

Novelty

First to integrate layered causality analysis with leakage-safe ML evaluation specifically for cryptoasset liquidity spillovers

Limitations

- Moderate out-of-sample predictive accuracy

- Sensitivity to RS-window selection in Layer C

- Potential structural breaks in data

Future Work

- Exploring longer time series for improved accuracy

- Investigating alternative volatility proxies

- Enhancing robustness to structural breaks

Paper Details

PDF Preview

Similar Papers

Found 4 papersEnhancing Meme Token Market Transparency: A Multi-Dimensional Entity-Linked Address Analysis for Liquidity Risk Evaluation

Xueyan Tang, Qian Huang, Haishan Wu et al.

A Predictive Framework Integrating Multi-Scale Volatility Components and Time-Varying Quantile Spillovers: Evidence from the Cryptocurrency Market

Fangfang Zhu, Sicheng Fu, Xiangdong Liu

Hybrid Models for Financial Forecasting: Combining Econometric, Machine Learning, and Deep Learning Models

Robert Ślepaczuk, Dominik Stempień

Comments (0)