Authors

Summary

This paper investigates the dynamics of risk transmission in cryptocurrency markets and proposes a novel framework for volatility forecasting. The framework uncovers two key empirical facts: the asymmetric amplification of volatility spillovers in both tails, and a structural decoupling between market size and systemic importance. Building on these insights, we develop a state-adaptive volatility forecasting model by extracting time-varying quantile spillover features across different volatility components. These features are embedded into an extended Log-HAR structure, resulting in the SA-Log-HAR model. Empirical results demonstrate that the proposed model outperforms benchmark alternatives in both in-sample fitting and out-of-sample forecasting, particularly in capturing extreme volatility and tail risks with greater robustness and explanatory power.

AI Key Findings

Generated Aug 01, 2025

Methodology

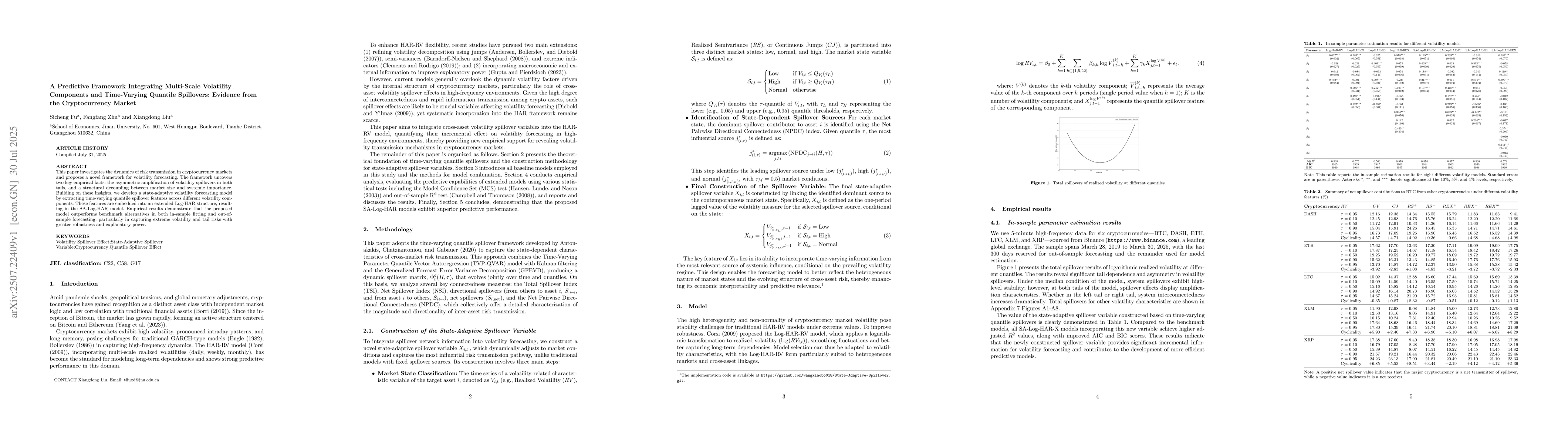

The research employs a state-adaptive volatility forecasting model that extracts time-varying quantile spillover features across different volatility components, integrating them into an extended Log-HAR structure (SA-Log-HAR model). It evaluates the model using a 500-day forecasting horizon with high-frequency Bitcoin data from Binance.

Key Results

- The SA-Log-HAR model outperforms benchmark alternatives in both in-sample fitting and out-of-sample forecasting, especially in capturing extreme volatility and tail risks with greater robustness and explanatory power.

- The study identifies two empirical facts: asymmetric amplification of volatility spillovers in both tails and a structural decoupling between market size and systemic importance in cryptocurrency markets.

- Lasso-SA-Log-HAR-RS model stands out for medium-term forecasts, while simpler Log-HAR-RV and SA-Log-HAR-RV models demonstrate outstanding predictive performance for long-term forecasting.

Significance

This research enriches understanding of risk characteristics in cryptocurrency markets, offering more targeted insights for investors and policymakers by highlighting the critical role of internal market spillover mechanisms in enhancing predictive performance.

Technical Contribution

The paper introduces a novel predictive framework integrating multi-scale volatility components and time-varying quantile spillovers, enhancing volatility forecasting in cryptocurrency markets.

Novelty

The research distinguishes itself by uncovering asymmetric amplification of volatility spillovers in both tails and a structural decoupling between market size and systemic importance, providing a more nuanced understanding of risk transmission in cryptocurrency markets.

Limitations

- The study is limited to Bitcoin data, so findings may not generalize to other cryptocurrencies without further investigation.

- Reliance on historical data may not fully capture future market dynamics, especially given the volatile and rapidly evolving nature of cryptocurrencies.

Future Work

- Explore the applicability of the proposed framework to other cryptocurrencies beyond Bitcoin.

- Investigate the model's performance during extreme market events not covered in the historical data.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian framework for characterizing cryptocurrency market dynamics, structural dependency, and volatility using potential field

Anoop C V, Neeraj Negi, Anup Aprem

A Multi-Layer Machine Learning and Econometric Pipeline for Forecasting Market Risk: Evidence from Cryptoasset Liquidity Spillovers

Yimeng Qiu, Feihuang Fang

Bayesian Multivariate Quantile Regression with alternative Time-varying Volatility Specifications

Matteo Iacopini, Luca Rossini, Francesco Ravazzolo

No citations found for this paper.

Comments (0)