Authors

Summary

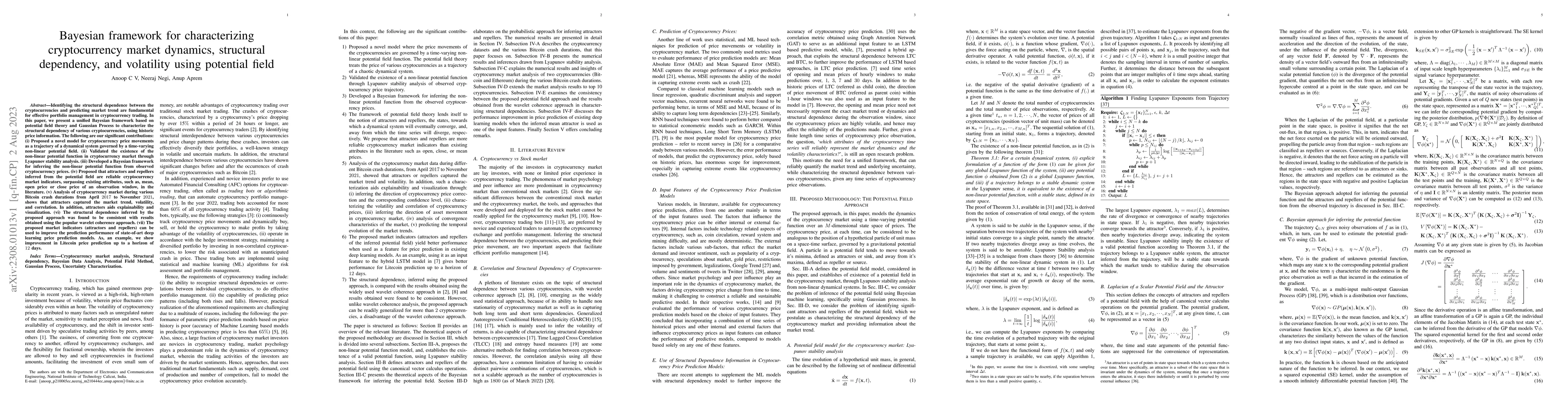

Identifying the structural dependence between the cryptocurrencies and predicting market trend are fundamental for effective portfolio management in cryptocurrency trading. In this paper, we present a unified Bayesian framework based on potential field theory and Gaussian Process to characterize the structural dependency of various cryptocurrencies, using historic price information. The following are our significant contributions: (i) Proposed a novel model for cryptocurrency price movements as a trajectory of a dynamical system governed by a time-varying non-linear potential field. (ii) Validated the existence of the non-linear potential function in cryptocurrency market through Lyapunov stability analysis. (iii) Developed a Bayesian framework for inferring the non-linear potential function from observed cryptocurrency prices. (iv) Proposed that attractors and repellers inferred from the potential field are reliable cryptocurrency market indicators, surpassing existing attributes, such as, mean, open price or close price of an observation window, in the literature. (v) Analysis of cryptocurrency market during various Bitcoin crash durations from April 2017 to November 2021, shows that attractors captured the market trend, volatility, and correlation. In addition, attractors aids explainability and visualization. (vi) The structural dependence inferred by the proposed approach was found to be consistent with results obtained using the popular wavelet coherence approach. (vii) The proposed market indicators (attractors and repellers) can be used to improve the prediction performance of state-of-art deep learning price prediction models. As, an example, we show improvement in Litecoin price prediction up to a horizon of 12 days.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Predictive Framework Integrating Multi-Scale Volatility Components and Time-Varying Quantile Spillovers: Evidence from the Cryptocurrency Market

Fangfang Zhu, Sicheng Fu, Xiangdong Liu

No citations found for this paper.

Comments (0)