Summary

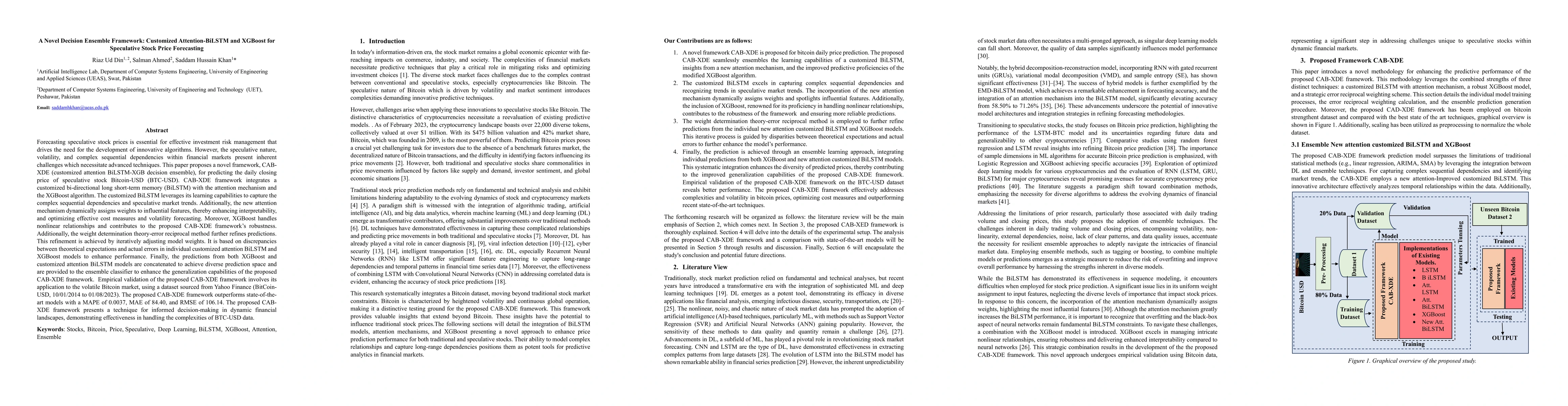

Forecasting speculative stock prices is essential for effective investment risk management that drives the need for the development of innovative algorithms. However, the speculative nature, volatility, and complex sequential dependencies within financial markets present inherent challenges which necessitate advanced techniques. This paper proposes a novel framework, CAB-XDE (customized attention BiLSTM-XGB decision ensemble), for predicting the daily closing price of speculative stock Bitcoin-USD (BTC-USD). CAB-XDE framework integrates a customized bi-directional long short-term memory (BiLSTM) with the attention mechanism and the XGBoost algorithm. The customized BiLSTM leverages its learning capabilities to capture the complex sequential dependencies and speculative market trends. Additionally, the new attention mechanism dynamically assigns weights to influential features, thereby enhancing interpretability, and optimizing effective cost measures and volatility forecasting. Moreover, XGBoost handles nonlinear relationships and contributes to the proposed CAB-XDE framework robustness. Additionally, the weight determination theory-error reciprocal method further refines predictions. This refinement is achieved by iteratively adjusting model weights. It is based on discrepancies between theoretical expectations and actual errors in individual customized attention BiLSTM and XGBoost models to enhance performance. Finally, the predictions from both XGBoost and customized attention BiLSTM models are concatenated to achieve diverse prediction space and are provided to the ensemble classifier to enhance the generalization capabilities of CAB-XDE. The proposed CAB-XDE framework is empirically validated on volatile Bitcoin market, sourced from Yahoo Finance and outperforms state-of-the-art models with a MAPE of 0.0037, MAE of 84.40, and RMSE of 106.14.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHAELT: A Hybrid Attentive Ensemble Learning Transformer Framework for High-Frequency Stock Price Forecasting

Thanh Dan Bui

Attention-based CNN-LSTM and XGBoost hybrid model for stock prediction

Jian Wu, Yang Hu, Zhuangwei Shi et al.

ResNLS: An Improved Model for Stock Price Forecasting

Basem Suleiman, Ali Anaissi, Yuanzhe Jia

| Title | Authors | Year | Actions |

|---|

Comments (0)