Summary

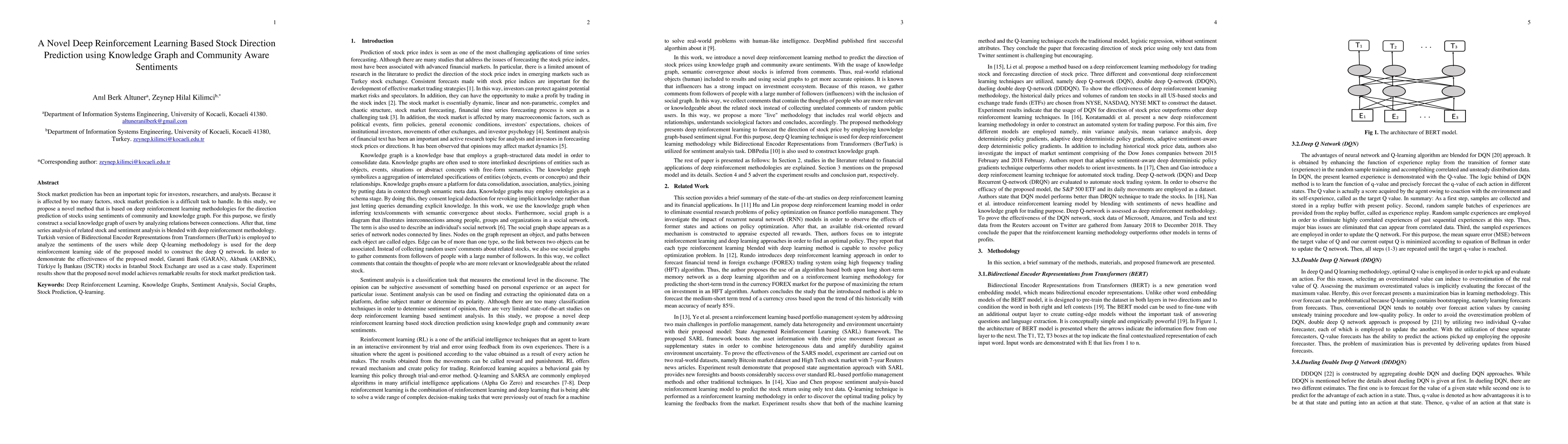

Stock market prediction has been an important topic for investors, researchers, and analysts. Because it is affected by too many factors, stock market prediction is a difficult task to handle. In this study, we propose a novel method that is based on deep reinforcement learning methodologies for the direction prediction of stocks using sentiments of community and knowledge graph. For this purpose, we firstly construct a social knowledge graph of users by analyzing relations between connections. After that, time series analysis of related stock and sentiment analysis is blended with deep reinforcement methodology. Turkish version of Bidirectional Encoder Representations from Transformers (BerTurk) is employed to analyze the sentiments of the users while deep Q-learning methodology is used for the deep reinforcement learning side of the proposed model to construct the deep Q network. In order to demonstrate the effectiveness of the proposed model, Garanti Bank (GARAN), Akbank (AKBNK), T\"urkiye \.I\c{s} Bankas{\i} (ISCTR) stocks in Istanbul Stock Exchange are used as a case study. Experiment results show that the proposed novel model achieves remarkable results for stock market prediction task.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Novel Deep Reinforcement Learning Based Automated Stock Trading System Using Cascaded LSTM Networks

Jie Zou, Jiashu Lou, Baohua Wang et al.

A Distillation-based Future-aware Graph Neural Network for Stock Trend Prediction

Bin Zhang, Peibo Duan, Zhipeng Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)