Authors

Summary

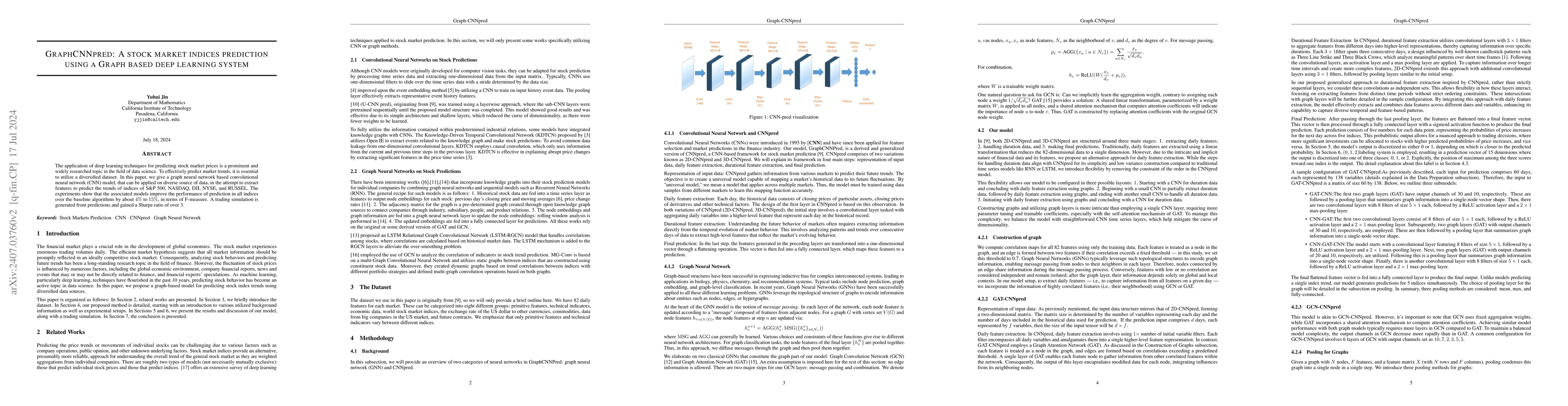

The application of deep learning techniques for predicting stock market prices is a prominent and widely researched topic in the field of data science. To effectively predict market trends, it is essential to utilize a diversified dataset. In this paper, we give a graph neural network based convolutional neural network (CNN) model, that can be applied on diverse source of data, in the attempt to extract features to predict the trends of indices of \text{S}\&\text{P} 500, NASDAQ, DJI, NYSE, and RUSSEL. The experiments show that the associated models improve the performance of prediction in all indices over the baseline algorithms by about $4\% \text{ to } 15\%$, in terms of F-measure. A trading simulation is generated from predictions and gained a Sharpe ratio of over 3.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStock Market Prediction via Deep Learning Techniques: A Survey

Ehsan Abbasnejad, Lingqiao Liu, Javen Qinfeng Shi et al.

Transformer-Based Deep Learning Model for Stock Price Prediction: A Case Study on Bangladesh Stock Market

Mohammad Shafiul Alam, Muhammad Ibrahim, Tashreef Muhammad et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)