Summary

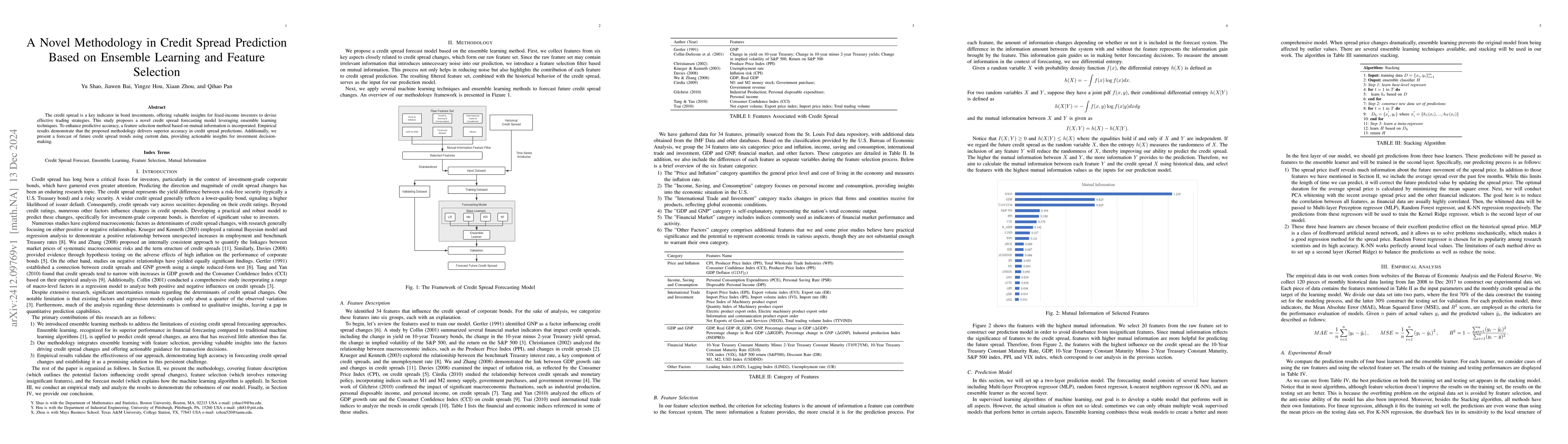

The credit spread is a key indicator in bond investments, offering valuable insights for fixed-income investors to devise effective trading strategies. This study proposes a novel credit spread forecasting model leveraging ensemble learning techniques. To enhance predictive accuracy, a feature selection method based on mutual information is incorporated. Empirical results demonstrate that the proposed methodology delivers superior accuracy in credit spread predictions. Additionally, we present a forecast of future credit spread trends using current data, providing actionable insights for investment decision-making.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterpretable Credit Default Prediction with Ensemble Learning and SHAP

Shiqi Yang, Xinyu Shen, Ziyi Huang et al.

Ensemble Methodology:Innovations in Credit Default Prediction Using LightGBM, XGBoost, and LocalEnsemble

Ye Zhang, Xu Yan, Yulu Gong et al.

Enhancing Credit Default Prediction Using Boruta Feature Selection and DBSCAN Algorithm with Different Resampling Techniques

Obu-Amoah Ampomah, Edmund Agyemang, Kofi Acheampong et al.

Enhanced Credit Score Prediction Using Ensemble Deep Learning Model

Chang Yu, Qianwen Xing, Qi Zheng et al.

No citations found for this paper.

Comments (0)